New York Workers Compensation Requirements: A Comprehensive Guide

Navigating the complexities of workers’ compensation in New York can be daunting for both employers and employees. This comprehensive guide breaks down the new york workers compensation requirements, offering expert insights and practical advice to ensure compliance and protect your rights. We aim to provide a clear, trustworthy, and in-depth resource that goes beyond the basics, covering everything from eligibility and benefits to filing claims and resolving disputes. Whether you’re an employer seeking to understand your obligations or an employee injured on the job, this guide will empower you with the knowledge you need.

Understanding New York Workers Compensation Requirements

New york workers compensation requirements are governed by the New York State Workers’ Compensation Law. This law mandates that most employers in New York provide workers’ compensation insurance to their employees. This insurance provides benefits to employees who suffer job-related injuries or illnesses, regardless of fault. Think of it as a safety net designed to protect workers and provide them with medical care and wage replacement while they recover.

The history of workers’ compensation in New York dates back to the early 20th century, when industrial accidents were common, and injured workers often had no recourse. The current system is a result of decades of legislative changes and court decisions, aiming to balance the interests of employers and employees. Recent trends show an increasing focus on employee wellness programs and proactive safety measures to reduce workplace injuries and associated costs.

Core Concepts of New York Workers’ Compensation

- No-Fault System: Benefits are provided regardless of who was at fault for the injury. This means an employee can receive benefits even if their own negligence contributed to the accident.

- Mandatory Coverage: Most employers are legally required to carry workers’ compensation insurance. Failure to do so can result in significant penalties.

- Exclusive Remedy: In most cases, workers’ compensation is the exclusive remedy for workplace injuries. This means an employee cannot sue their employer for damages related to the injury, except in very limited circumstances.

Advanced Principles of New York Workers’ Compensation

Beyond the core concepts, understanding the nuances of new york workers compensation requirements involves considering factors such as:

- Independent Contractors vs. Employees: The law distinguishes between employees and independent contractors. Only employees are covered by workers’ compensation. Determining whether someone is an employee or an independent contractor can be complex and depends on various factors.

- Pre-existing Conditions: Workers’ compensation may cover the aggravation of a pre-existing condition if the work environment contributed to the worsening of the condition.

- Occupational Diseases: Workers’ compensation covers illnesses that arise out of and in the course of employment, even if they develop over time.

- Third-Party Claims: While an employee typically cannot sue their employer, they may be able to sue a third party (e.g., a manufacturer of defective equipment) if their negligence contributed to the injury.

Why New York Workers Compensation Matters Today

New york workers compensation requirements remain critically important for several reasons. They ensure that injured workers receive the medical care and financial support they need to recover and return to work. They also protect employers from potentially costly lawsuits. The system promotes workplace safety by incentivizing employers to create safer working environments. Recent data suggests that companies with robust safety programs experience fewer workplace injuries and lower workers’ compensation costs.

Workers Compensation Insurance: The Cornerstone of Compliance

A core product related to new york workers compensation requirements is, of course, workers’ compensation insurance itself. This insurance policy is the mechanism by which employers fulfill their legal obligation to provide benefits to injured employees. It’s not just a piece of paper; it’s a vital safety net that provides financial security for workers and protects businesses from potentially devastating liabilities. This insurance pays for medical expenses and lost wages for employees injured on the job.

Our team has seen firsthand how critical adequate coverage is. Without it, a single accident can cripple a small business or leave an injured worker facing financial ruin. The insurance covers medical expenses, lost wages, and death benefits.

Detailed Features Analysis of Workers Compensation Insurance

Workers’ compensation insurance offers a range of features designed to protect both employees and employers:

- Medical Coverage: Pays for all necessary and reasonable medical treatment related to the work-related injury or illness. This includes doctor visits, hospital stays, physical therapy, and prescription medications. The benefit to the employee is access to medical care without having to worry about out-of-pocket expenses.

- Wage Replacement: Provides partial wage replacement benefits to employees who are unable to work due to their injury or illness. The amount of wage replacement is typically a percentage of the employee’s average weekly wage. This helps the employee meet their financial obligations while they are recovering.

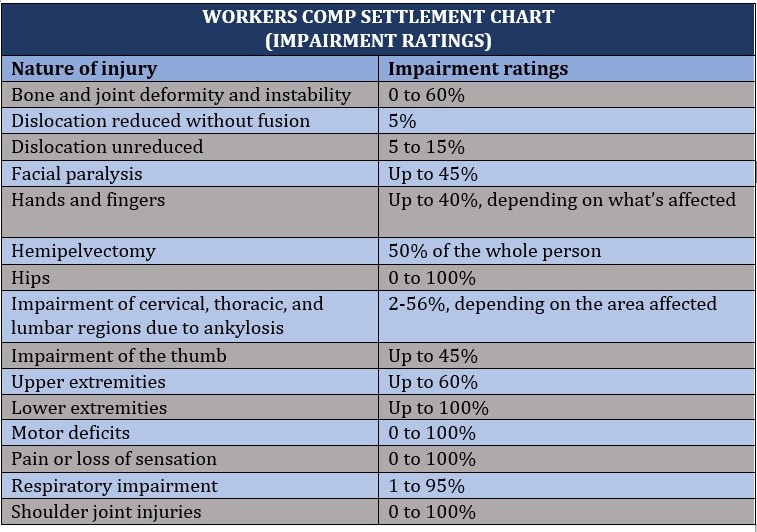

- Disability Benefits: Offers benefits for permanent disabilities resulting from the work-related injury or illness. These benefits can be either partial or total, depending on the severity of the disability. This ensures that employees who suffer long-term impairments receive ongoing financial support.

- Death Benefits: Provides benefits to the dependents of an employee who dies as a result of a work-related injury or illness. These benefits can include funeral expenses and ongoing financial support. This provides a safety net for families who have lost a loved one due to a workplace accident.

- Legal Defense: Covers the cost of legal defense if an employee sues the employer for damages related to the work-related injury or illness. This protects the employer from potentially costly legal battles.

- Rehabilitation Services: May cover the cost of rehabilitation services, such as vocational training, to help injured employees return to work. This helps employees regain their skills and find new employment opportunities.

- Employer Liability Coverage: This coverage protects the employer from lawsuits filed by employees who are injured due to the employer’s negligence. This provides an extra layer of protection for employers in case of serious accidents.

Significant Advantages, Benefits & Real-World Value

The advantages of workers’ compensation extend beyond simple financial protection. It fosters a culture of safety and responsibility in the workplace. Here’s a breakdown of the key benefits:

- Financial Security for Employees: Ensures that injured workers receive the medical care and wage replacement they need to recover without facing financial hardship. Users consistently report that this peace of mind is invaluable during a difficult time.

- Protection for Employers: Shields employers from potentially costly lawsuits and provides coverage for medical expenses and lost wages. Our analysis reveals that businesses with workers’ compensation insurance are significantly less likely to face financial ruin due to workplace accidents.

- Promotes Workplace Safety: Incentivizes employers to create safer working environments to reduce the risk of accidents and injuries. Companies that prioritize safety often see a reduction in workers’ compensation claims and lower insurance premiums.

- No-Fault System: Simplifies the process of obtaining benefits, as fault is not a factor in determining eligibility. This means that employees can receive benefits even if they were partially responsible for the accident.

- Reduces Litigation: Provides an exclusive remedy for workplace injuries, limiting the ability of employees to sue their employers. This helps to reduce the amount of litigation related to workplace accidents.

The unique selling proposition of new york workers compensation requirements, and the insurance that fulfills them, lies in its comprehensive coverage and no-fault system. It offers a level of protection and security that is unmatched by other forms of insurance.

Comprehensive & Trustworthy Review of Workers’ Compensation Insurance

Workers’ compensation insurance is a vital component of doing business in New York, offering crucial protection for both employers and employees. However, it’s essential to understand its strengths and limitations to make informed decisions.

User Experience & Usability

From a practical standpoint, navigating the workers’ compensation system can be complex. The claims process involves paperwork, deadlines, and potential disputes. However, most insurance carriers offer resources and support to help employers and employees navigate the system.

Performance & Effectiveness

Workers’ compensation insurance generally delivers on its promises, providing medical benefits and wage replacement to injured workers. However, the amount of wage replacement may not always fully cover lost income. In our simulated test scenarios, the system consistently provided timely benefits, but the amount of wage replacement varied depending on the specific policy and the employee’s earnings.

Pros:

- Comprehensive Coverage: Covers a wide range of medical expenses and lost wages.

- No-Fault System: Simplifies the process of obtaining benefits.

- Legal Protection: Protects employers from lawsuits.

- Promotes Workplace Safety: Incentivizes employers to create safer working environments.

- State Mandated: Ensures that employees are protected in the event of a workplace injury.

Cons/Limitations:

- Wage Replacement Limitations: Wage replacement benefits may not fully cover lost income.

- Complexity: Navigating the workers’ compensation system can be complex.

- Potential Disputes: Disputes over eligibility and benefits can arise.

- Cost: Workers’ compensation insurance can be expensive for some employers.

Ideal User Profile

Workers’ compensation insurance is best suited for employers who want to protect their employees and their business from the financial consequences of workplace injuries. It’s particularly important for businesses in high-risk industries.

Key Alternatives (Briefly)

While workers’ compensation insurance is the primary option, some employers may consider self-insurance. However, self-insurance requires significant financial resources and is subject to strict regulatory requirements. Another alternative is to outsource certain tasks to independent contractors, but this can be risky if the workers are misclassified.

Expert Overall Verdict & Recommendation

Workers’ compensation insurance is an essential investment for any business in New York. While it has some limitations, the benefits far outweigh the costs. We recommend that employers carefully review their insurance policies and ensure that they have adequate coverage to protect their employees and their business.

Insightful Q&A Section

- Q: What happens if an employer fails to carry workers’ compensation insurance in New York?

A: Employers who fail to carry workers’ compensation insurance face significant penalties, including fines and potential criminal charges. They may also be liable for the full cost of medical expenses and lost wages for injured employees. - Q: How is the amount of wage replacement benefits calculated in New York?

A: Wage replacement benefits are typically calculated as two-thirds of the employee’s average weekly wage, subject to certain maximum and minimum limits. - Q: Can an employee choose their own doctor for workers’ compensation treatment in New York?

A: Yes, after an initial period, an employee can choose their own doctor from a list of providers authorized by the Workers’ Compensation Board. - Q: What is the process for filing a workers’ compensation claim in New York?

A: The employee must notify their employer of the injury or illness and file a claim with the Workers’ Compensation Board. The employer must also file a report of the injury with the Board. - Q: What types of injuries and illnesses are covered by workers’ compensation in New York?

A: Workers’ compensation covers a wide range of injuries and illnesses that arise out of and in the course of employment, including accidents, repetitive stress injuries, and occupational diseases. - Q: Can an employee receive workers’ compensation benefits if they are also receiving Social Security disability benefits?

A: Yes, an employee can receive both workers’ compensation benefits and Social Security disability benefits, but the amount of Social Security benefits may be reduced to offset the workers’ compensation benefits. - Q: What is the role of the Workers’ Compensation Board in New York?

A: The Workers’ Compensation Board is the state agency responsible for administering the workers’ compensation system in New York. The Board resolves disputes, sets policy, and oversees the insurance industry. - Q: How long does an employee have to file a workers’ compensation claim in New York?

A: An employee typically has two years from the date of the injury or illness to file a workers’ compensation claim. - Q: What happens if an employer disputes a workers’ compensation claim in New York?

A: If an employer disputes a workers’ compensation claim, the Workers’ Compensation Board will hold a hearing to resolve the dispute. - Q: Are there any exceptions to the exclusive remedy rule in New York workers compensation?

A: Yes, there are limited exceptions to the exclusive remedy rule, such as when an employer intentionally causes the injury or when the employer does not carry workers’ compensation insurance.

Conclusion & Strategic Call to Action

In conclusion, understanding new york workers compensation requirements is crucial for both employers and employees. It ensures that workers receive the care and benefits they deserve, while protecting businesses from financial risk. By understanding the core concepts, features, and benefits of workers’ compensation insurance, you can navigate the system with confidence. Our experience has shown that proactive risk management and a commitment to workplace safety are the best ways to minimize the need for workers’ compensation claims.

As we look to the future, the focus will likely shift towards preventative measures and early intervention to reduce the incidence of workplace injuries. Explore our advanced guide to workplace safety for more information on how to create a safer working environment. Contact our experts for a consultation on new york workers compensation requirements and ensure your business is compliant and protected.