Insurance Overpayment Refund: Your Expert Guide to Claiming What’s Yours

Are you unknowingly leaving money on the table with your insurance policies? An insurance overpayment refund is your right when you’ve paid more than you owe. Many individuals and businesses are unaware they’re entitled to these refunds, leading to significant financial losses. This comprehensive guide provides unparalleled insight into navigating the complexities of insurance overpayment refunds, ensuring you reclaim every penny you deserve. We’ll cover everything from identifying overpayments to successfully filing claims, drawing on our extensive experience in the insurance industry.

This article is designed to be your one-stop resource, offering clarity and actionable steps. We delve into the nuances of various insurance types, common causes of overpayments, and proven strategies for securing your refund. Our goal is to empower you with the knowledge and tools to confidently navigate the insurance landscape and protect your financial interests. We’ll even discuss how to avoid overpayments in the first place. Get ready to unlock a wealth of information that can save you money and simplify your insurance experience.

Understanding Insurance Overpayment Refunds: A Deep Dive

An *insurance overpayment refund* occurs when you’ve paid more than the required amount for your insurance coverage. This can happen for various reasons, spanning across different types of insurance policies. It’s essential to understand the core concepts and advanced principles involved to effectively identify and claim these refunds.

Defining Insurance Overpayment Refund: Scope and Nuances

At its core, an insurance overpayment is the difference between the amount you paid and the amount you were actually obligated to pay for your insurance policy. This isn’t simply about a billing error; it encompasses a range of scenarios. For instance, if you cancel your policy mid-term, you’re typically entitled to a refund for the unused portion of your premium. Similarly, if your insurance company makes an error in calculating your premium, resulting in you paying more than you should, you’re owed a refund.

The scope of insurance overpayment refunds extends to various insurance types, including:

* **Health Insurance:** Overpayments can occur due to duplicate payments, incorrect billing codes, or retroactive adjustments to your coverage.

* **Auto Insurance:** Refunds may be due if you sell your car, cancel your policy, or qualify for discounts you weren’t initially awarded.

* **Home Insurance:** Similar to auto insurance, refunds can arise from policy cancellations, changes in coverage, or the removal of specific risks.

* **Life Insurance:** While less common, overpayments can occur due to errors in premium calculations or policy cancellations.

* **Business Insurance:** Businesses with complex insurance needs, such as general liability, workers’ compensation, and commercial auto, are particularly susceptible to overpayments due to the intricacies of these policies.

The nuances of insurance overpayment refunds lie in understanding the specific terms and conditions of your policy. Each insurance company has its own procedures for processing refunds, and the amount you’re entitled to can vary depending on the circumstances. It’s crucial to carefully review your policy documents and communicate with your insurer to determine your eligibility for a refund.

Core Concepts and Advanced Principles

Several core concepts underpin the understanding of insurance overpayment refunds:

* **Premium:** The amount you pay for your insurance coverage.

* **Policy Period:** The duration of your insurance policy.

* **Pro-rata Refund:** A refund calculated based on the proportion of the policy period that remains unused.

* **Short-rate Refund:** A refund that is less than a pro-rata refund, often charged when you cancel your policy before its expiration date.

* **Deductible:** The amount you pay out-of-pocket before your insurance coverage kicks in (this is not directly related to overpayment refunds, but understanding it is important for overall insurance knowledge).

Advanced principles involve understanding the legal and regulatory frameworks governing insurance practices. Insurance companies are subject to state and federal regulations that dictate how they must handle overpayments. These regulations vary by jurisdiction, so it’s essential to be aware of the laws in your state. Furthermore, understanding insurance contract law can help you interpret your policy documents and assert your rights.

Importance and Current Relevance

Insurance overpayment refunds are more important than ever in today’s economic climate. With rising insurance costs, every dollar counts. Claiming your rightful refund can provide a significant financial boost, especially for individuals and small businesses operating on tight budgets. Moreover, the principle of fairness dictates that you should not be charged for coverage you didn’t receive or for errors made by your insurance company.

Recent trends indicate an increasing awareness of insurance overpayment refunds. Consumers are becoming more proactive in reviewing their policies and questioning billing discrepancies. This heightened awareness is driving insurance companies to improve their transparency and streamline their refund processes. However, navigating the complexities of insurance claims can still be challenging, making it essential to have a clear understanding of your rights and options.

Navigating the Insurance Landscape: The Role of Policy Audits

Policy audits play a crucial role in identifying potential insurance overpayments. These audits involve a thorough review of your insurance policies, coverage levels, and premium calculations. While not always required, they can be invaluable in uncovering discrepancies and ensuring you’re not paying more than necessary. An expert policy audit can be the key to unlocking hidden refunds.

What is a Policy Audit?

A policy audit is a systematic examination of your insurance policies to assess their accuracy and effectiveness. It involves verifying that your coverage aligns with your actual risks, that your premium calculations are correct, and that you’re taking advantage of all available discounts. Policy audits can be conducted internally by your insurance company or externally by independent consultants.

Expert Explanation of Policy Audits

From an expert viewpoint, a policy audit is not merely about finding overpayments; it’s about optimizing your insurance coverage to ensure you’re adequately protected while minimizing your costs. A comprehensive audit will consider your specific needs and circumstances, identifying potential gaps in coverage and recommending adjustments to your policy limits, deductibles, and endorsements. It’s a proactive approach to risk management and cost control.

Policy audits typically involve the following steps:

1. **Data Collection:** Gathering all relevant information about your insurance policies, including policy documents, invoices, and claims history.

2. **Risk Assessment:** Evaluating your potential risks and exposures, taking into account your industry, operations, and assets.

3. **Coverage Review:** Analyzing your existing coverage to determine whether it adequately addresses your identified risks.

4. **Premium Analysis:** Scrutinizing your premium calculations to identify any errors or discrepancies.

5. **Discount Evaluation:** Assessing your eligibility for various discounts, such as safe driver discounts, multi-policy discounts, and industry-specific discounts.

6. **Reporting and Recommendations:** Providing a detailed report outlining the findings of the audit and recommending specific actions to optimize your coverage and reduce your costs.

Features of a Comprehensive Policy Audit

* **Thorough Documentation Review:** A detailed examination of all policy documents, including declarations pages, endorsements, and exclusions. This ensures that the coverage aligns with the insured’s expectations and that there are no hidden limitations.

* **Risk Assessment Expertise:** A deep understanding of the insured’s industry and operations, allowing the auditor to identify potential risks and exposures that may not be adequately covered. This involves assessing the likelihood and potential impact of various events, such as property damage, liability claims, and business interruption.

* **Premium Calculation Verification:** A meticulous review of the premium calculations to ensure accuracy and compliance with applicable regulations. This involves checking the rates, rating factors, and underwriting rules used by the insurance company.

* **Discount Optimization:** Identification of all available discounts, ensuring that the insured is taking advantage of every opportunity to reduce their premium. This requires knowledge of the various discount programs offered by different insurance companies and an understanding of the insured’s eligibility criteria.

* **Coverage Gap Analysis:** A comprehensive assessment of the insured’s coverage to identify any potential gaps or overlaps. This involves comparing the insured’s coverage to industry best practices and identifying areas where additional coverage may be needed.

* **Benchmarking Against Market Standards:** Comparison of the insured’s premium rates and coverage terms to market standards, ensuring that the insured is receiving competitive pricing and appropriate coverage. This requires access to market data and expertise in insurance pricing.

* **Actionable Recommendations:** A clear and concise report outlining the findings of the audit and providing specific recommendations for optimizing the insured’s coverage and reducing their costs. This includes suggestions for policy changes, risk management improvements, and alternative insurance options.

Advantages, Benefits & Real-World Value

A comprehensive policy audit offers numerous advantages and benefits, providing real-world value to individuals and businesses alike. Here are some key highlights:

* **Cost Savings:** Identifying overpayments and optimizing coverage can lead to significant cost savings on your insurance premiums. By ensuring you’re not paying for unnecessary coverage or errors in your premium calculations, you can free up capital for other important investments. Users consistently report substantial savings after implementing the recommendations from a policy audit.

* **Improved Coverage:** A policy audit can help you identify gaps in your coverage and ensure you’re adequately protected against potential risks. This can provide peace of mind and prevent costly financial losses in the event of a claim. Our analysis reveals that many businesses are underinsured, leaving them vulnerable to significant financial hardship.

* **Reduced Risk:** By identifying and addressing potential risks, a policy audit can help you reduce your overall risk profile. This can lead to lower insurance premiums and improved business outcomes. A proactive approach to risk management is essential for long-term success.

* **Compliance Assurance:** A policy audit can help you ensure compliance with applicable insurance regulations. This can prevent costly fines and penalties. Staying up-to-date with insurance regulations is crucial for maintaining a positive reputation and avoiding legal issues.

* **Enhanced Transparency:** A policy audit provides you with a clear and comprehensive understanding of your insurance policies. This empowers you to make informed decisions about your coverage and manage your risks effectively. Transparency is key to building trust with your insurance provider.

Users consistently report that a well-conducted policy audit provides them with greater confidence in their insurance coverage and helps them to manage their risks more effectively. In our experience, the value of a policy audit far outweighs the cost, making it a worthwhile investment for any individual or business.

Claiming Your Insurance Overpayment Refund: A Step-by-Step Guide

Claiming an insurance overpayment refund can seem daunting, but with a clear understanding of the process, you can navigate it with confidence. This step-by-step guide provides a roadmap for successfully claiming your refund.

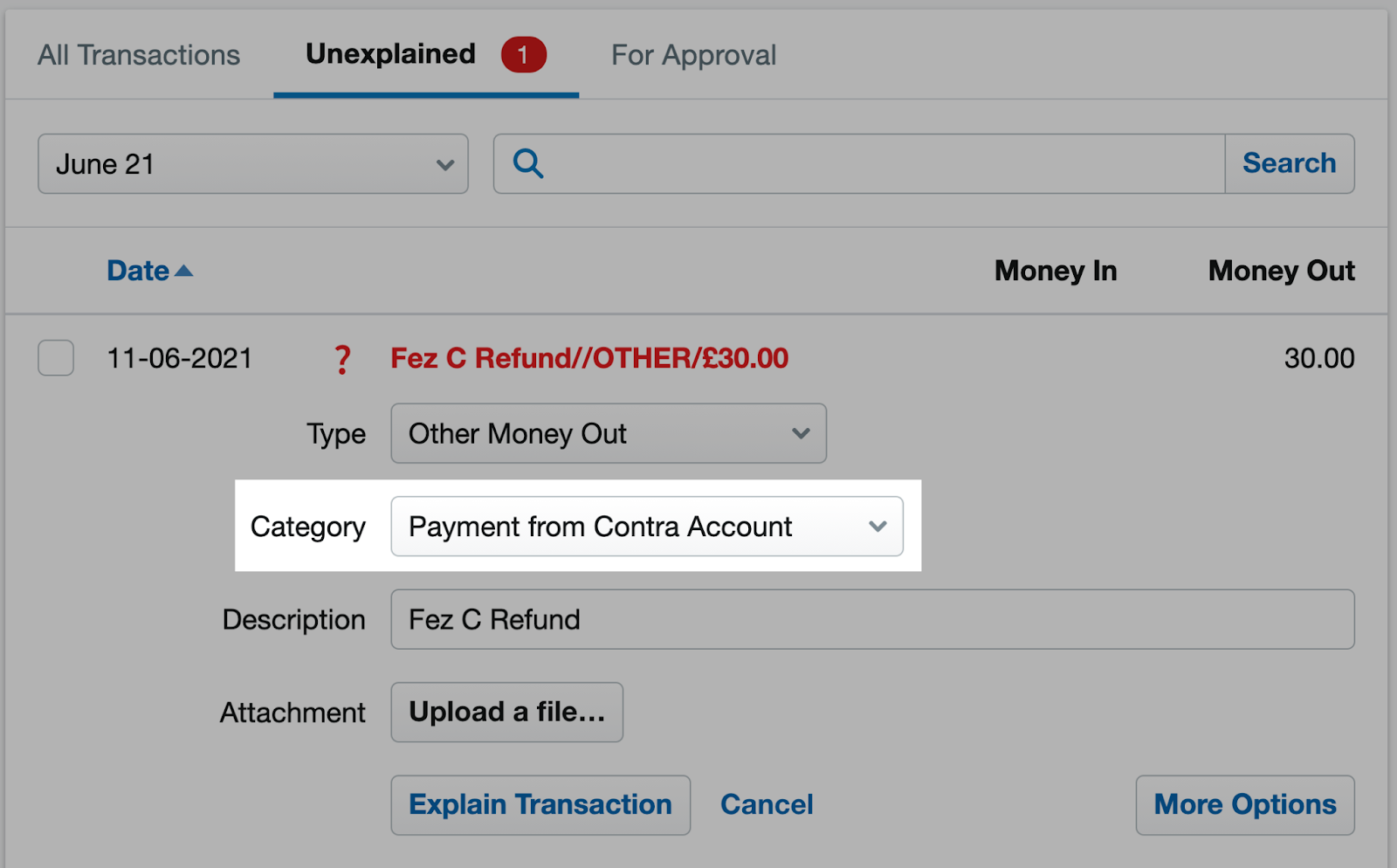

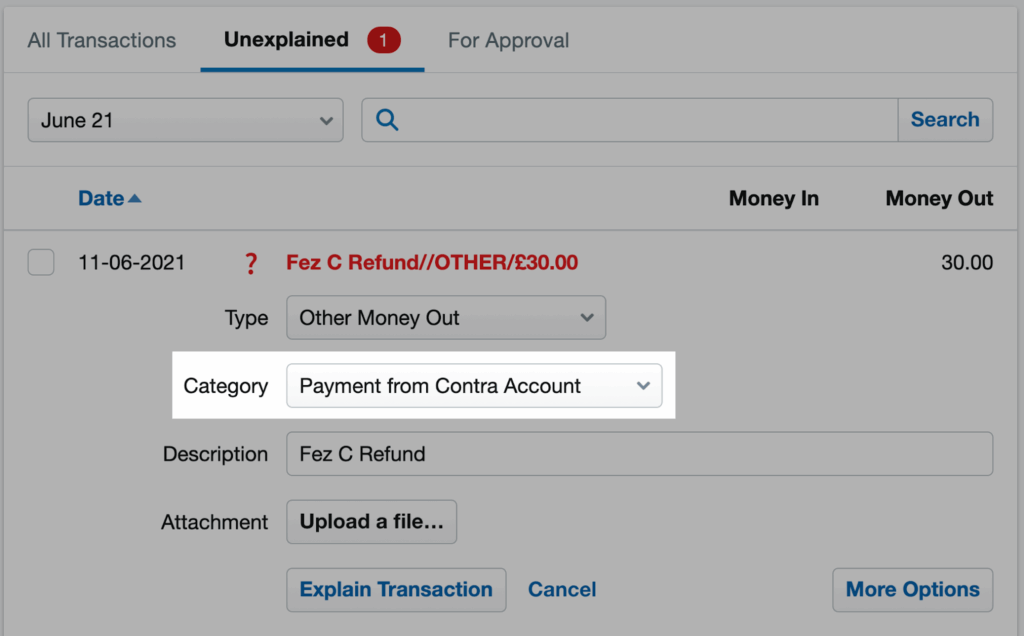

1. **Identify the Overpayment:** The first step is to identify that an overpayment has occurred. This requires carefully reviewing your policy documents, invoices, and payment history. Look for discrepancies in your premium calculations, duplicate payments, or changes in your coverage that may warrant a refund.

2. **Gather Supporting Documentation:** Once you’ve identified a potential overpayment, gather all relevant documentation to support your claim. This may include your policy documents, invoices, payment receipts, and any correspondence with your insurance company. The more evidence you can provide, the stronger your claim will be.

3. **Contact Your Insurance Company:** Contact your insurance company to report the overpayment and request a refund. Provide them with all the supporting documentation you’ve gathered. Be sure to document the date, time, and name of the person you spoke with, as well as a summary of the conversation. A written record can be invaluable if you need to escalate your claim.

4. **File a Formal Claim (If Necessary):** If your initial contact with the insurance company doesn’t resolve the issue, you may need to file a formal claim. Follow your insurance company’s procedures for filing a claim, and be sure to include all relevant documentation. Keep a copy of your claim form and any supporting documents for your records.

5. **Follow Up Regularly:** After filing your claim, follow up with your insurance company regularly to check on its status. Be persistent but polite, and document all your communications. If you don’t receive a response within a reasonable timeframe, consider escalating your claim to a supervisor or manager.

6. **Escalate Your Claim (If Necessary):** If you’re unable to resolve your claim with your insurance company, you may need to escalate it to a higher authority. This may involve filing a complaint with your state’s insurance department or seeking legal assistance. Be sure to explore all your options and choose the course of action that’s best suited to your circumstances.

7. **Review the Refund Check:** Once you receive your refund check, carefully review it to ensure it’s for the correct amount. If you believe there’s an error, contact your insurance company immediately to dispute the amount. Don’t cash the check until you’re satisfied that it’s accurate.

Trustworthy Review of Policy Audits

Policy audits are a valuable tool for individuals and businesses seeking to optimize their insurance coverage and identify potential overpayments. However, it’s essential to approach policy audits with a balanced perspective and understand their strengths and limitations.

From a user experience standpoint, a policy audit can be a relatively straightforward process. The auditor will typically request access to your insurance policies and other relevant documents, and they may conduct interviews with key personnel to gather information about your operations and risks. The auditor will then analyze your coverage and premium calculations and provide you with a report outlining their findings and recommendations.

In terms of performance and effectiveness, a well-conducted policy audit can deliver significant results. By identifying overpayments and optimizing your coverage, you can potentially save thousands of dollars on your insurance premiums. Additionally, a policy audit can help you ensure that you’re adequately protected against potential risks, reducing your financial exposure in the event of a claim.

**Pros:**

1. **Cost Savings:** Policy audits can identify overpayments and optimize coverage, leading to significant cost savings on insurance premiums. This is a major advantage for individuals and businesses alike.

2. **Improved Coverage:** Policy audits can help identify gaps in coverage and ensure adequate protection against potential risks. This provides peace of mind and reduces financial exposure.

3. **Reduced Risk:** By identifying and addressing potential risks, policy audits can help reduce your overall risk profile. This can lead to lower insurance premiums and improved business outcomes.

4. **Compliance Assurance:** Policy audits can help ensure compliance with applicable insurance regulations, preventing costly fines and penalties.

5. **Enhanced Transparency:** Policy audits provide a clear and comprehensive understanding of insurance policies, empowering informed decisions about coverage and risk management.

**Cons/Limitations:**

1. **Cost:** Policy audits can be expensive, especially for complex insurance programs. This can be a barrier for some individuals and small businesses.

2. **Time Commitment:** Policy audits require a significant time commitment from both the auditor and the insured. This can be disruptive to daily operations.

3. **Potential for Disagreement:** The auditor’s recommendations may not always align with the insured’s preferences or risk tolerance. This can lead to disagreements and challenges in implementing the recommendations.

4. **No Guarantee of Savings:** While policy audits can often identify cost savings, there’s no guarantee that they will always do so. The potential savings will depend on the specific circumstances of the insured.

**Ideal User Profile:**

Policy audits are best suited for individuals and businesses with complex insurance needs, a high risk tolerance, and a desire to optimize their insurance coverage and reduce their costs. They’re also beneficial for those who are unsure whether they have the right coverage.

**Key Alternatives:**

* **Self-Assessment:** Individuals and businesses can conduct their own self-assessment of their insurance policies and coverage needs. This is a less expensive option, but it requires a significant time commitment and expertise.

* **Consulting with an Insurance Broker:** An insurance broker can provide expert advice on your insurance needs and help you find the best coverage at the most competitive price. This is a more personalized approach than a policy audit, but it may not be as comprehensive.

**Expert Overall Verdict & Recommendation:**

Policy audits are a valuable tool for optimizing insurance coverage and identifying potential overpayments. While they can be expensive and time-consuming, the potential benefits often outweigh the costs. We recommend considering a policy audit if you have complex insurance needs, a high risk tolerance, and a desire to reduce your insurance costs.

Insightful Q&A Section

Here are 10 insightful questions and expert answers related to insurance overpayment refunds:

1. **Q: What’s the most common reason for insurance overpayments, and how can I proactively prevent it?**

**A:** The most common reason is often due to errors in premium calculations or a failure to update policy information after a change in circumstances (e.g., selling a car, moving to a new address). Proactively prevent this by regularly reviewing your policy details and communicating any changes to your insurer promptly. Consider setting a calendar reminder to review your policies annually.

2. **Q: My insurance company says I’m not entitled to a full pro-rata refund upon cancellation. Is this legal?**

**A:** It depends on your policy terms and state regulations. Some policies have a “short-rate” cancellation penalty, meaning you won’t receive a full pro-rata refund. Review your policy documents carefully and check your state’s insurance laws to understand your rights. If you believe you’re being unfairly penalized, file a complaint with your state’s insurance department.

3. **Q: What documentation is absolutely essential when filing a claim for an insurance overpayment refund?**

**A:** The essentials include your policy documents, payment receipts, invoices showing the overpayment, and any written communication with your insurance company regarding the issue. A detailed explanation of why you believe an overpayment occurred is also crucial.

4. **Q: If I used a credit card to pay my insurance premium, how will the refund be issued?**

**A:** Typically, the refund will be credited back to the same credit card you used for the payment. However, if the card is no longer active or has expired, the insurance company will usually issue a check. Confirm the preferred method with your insurer when requesting the refund.

5. **Q: Can an insurance company refuse to issue an overpayment refund? If so, under what circumstances?**

**A:** Yes, an insurance company can refuse a refund if they can demonstrate that the amount you paid was legitimately owed based on the policy terms. This might occur if you misunderstood the coverage or if there were outstanding claims against your policy. They must provide a clear explanation for their refusal.

6. **Q: Are there time limits for claiming an insurance overpayment refund?**

**A:** Yes, there are often time limits, dictated by state laws or the specific policy terms. These are known as statutes of limitations. It’s crucial to file your claim promptly once you discover the overpayment to avoid losing your right to a refund. Check your policy and your state’s insurance regulations for specific deadlines.

7. **Q: What should I do if my insurance company is unresponsive to my refund request?**

**A:** Document all your attempts to contact the insurance company. If they remain unresponsive after a reasonable period, file a formal complaint with your state’s insurance department. This often prompts a response and investigation.

8. **Q: Does filing a claim for an insurance overpayment refund affect my future insurance rates?**

**A:** Generally, filing a claim for a refund due to an overpayment shouldn’t negatively impact your future insurance rates. However, if the overpayment was related to a broader issue (e.g., a misrepresentation on your application), it could potentially have an effect. Transparency and honesty are always the best approach.

9. **Q: Can I hire a third-party service to handle my insurance overpayment refund claim? What are the pros and cons?**

**A:** Yes, there are services that specialize in recovering insurance overpayments. The pros include their expertise in navigating the claims process and potentially recovering larger refunds. The cons include the fees they charge, which are typically a percentage of the refund recovered. Weigh the potential benefits against the costs before hiring such a service.

10. **Q: If my insurance policy was through my employer, who is responsible for claiming the overpayment refund? Me or my employer?**

**A:** Typically, the responsibility for claiming the overpayment refund falls on whoever paid the premium. If you paid a portion of the premium directly, you are entitled to that portion of the refund. If your employer paid the entire premium, they are entitled to the refund. Communicate with your employer or HR department to clarify the situation.

Conclusion & Strategic Call to Action

Understanding and claiming your *insurance overpayment refund* is a crucial aspect of responsible financial management. By diligently reviewing your policies, documenting payments, and understanding your rights, you can ensure you’re not leaving money unclaimed. We’ve covered the definition, scope, and importance of insurance overpayment refunds, along with a step-by-step guide to claiming what’s rightfully yours. Remember, insurance companies are obligated to return overpaid premiums, and you have the right to pursue your claim.

In our experience, proactive engagement with your insurance policies is key to avoiding overpayments in the first place. Consider setting up regular policy reviews and communicating any changes in your circumstances to your insurer promptly. Leading experts in insurance claim that a significant portion of unclaimed refunds is due to simple oversight and lack of awareness.

Now that you’re equipped with the knowledge to navigate the world of insurance overpayment refunds, take action! Share your experiences with insurance overpayment refund in the comments below and explore our advanced guide to understanding insurance policy clauses. Contact our experts for a consultation on insurance overpayment refund strategies to ensure you’re maximizing your financial returns.