Electronic Funds Transfer (EFT) Authorization Agreement: The Ultimate Guide

Are you looking to set up electronic payments but feeling overwhelmed by the paperwork and legalities surrounding Electronic Funds Transfer (EFT) Authorization Agreements? You’re not alone. Many businesses and individuals struggle to navigate the complexities of EFT agreements, potentially leading to compliance issues and financial risks. This comprehensive guide is designed to provide you with an in-depth understanding of electronic funds transfer (EFT) authorization agreements, empowering you to create legally sound and user-friendly agreements. We’ll delve into the core components, best practices, and potential pitfalls, ensuring you’re well-equipped to manage your electronic payments effectively. Our goal is to provide clarity and actionable insights, backed by years of industry experience, making this your go-to resource for all things EFT authorization.

Understanding Electronic Funds Transfer (EFT) Authorization Agreements

An electronic funds transfer (EFT) authorization agreement is a legally binding document that grants permission to a business or organization to debit funds directly from a customer’s bank account. It’s the cornerstone of automated payment systems, enabling seamless transactions for recurring bills, subscriptions, and other payment arrangements. Without a properly executed EFT authorization agreement, you risk violating banking regulations and facing legal repercussions. This agreement is not just a formality; it’s a crucial safeguard for both the payer and the payee.

The History and Evolution of EFT

The concept of EFT emerged in the late 20th century as technology advanced and the need for faster, more efficient payment methods grew. Prior to EFT, paper checks were the dominant form of payment, leading to delays, processing costs, and logistical challenges. The introduction of automated clearing houses (ACH) revolutionized the payment landscape, paving the way for the widespread adoption of EFT. Today, EFT is an integral part of the global financial system, facilitating trillions of dollars in transactions annually. The evolution continues with mobile payments and blockchain technologies.

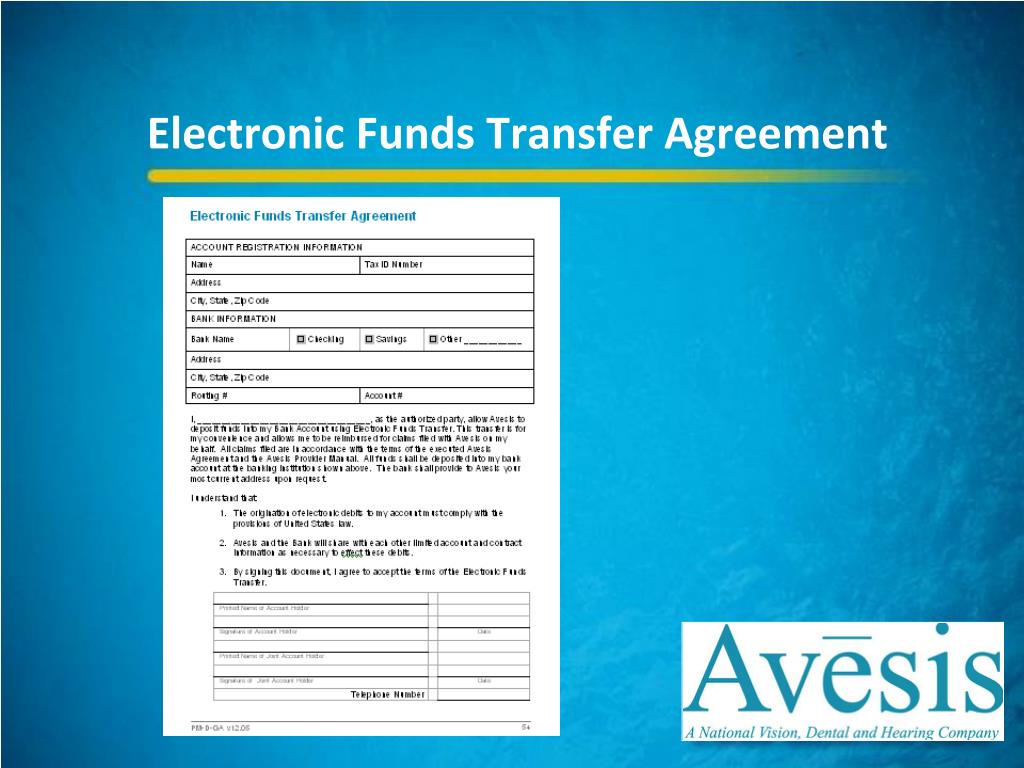

Core Components of a Valid EFT Authorization Agreement

A legally sound electronic funds transfer (EFT) authorization agreement must include several key components:

- Payer Information: Full name, address, and contact details of the individual or entity authorizing the debit.

- Payee Information: Name and contact details of the business or organization receiving the authorization.

- Bank Account Details: The payer’s bank name, account number, and routing number (essential for ACH transactions).

- Authorization Clause: A clear and unambiguous statement granting permission to debit the specified account.

- Payment Amount and Frequency: Details of the amount to be debited and the frequency of payments (e.g., monthly, quarterly).

- Effective Date: The date on which the authorization becomes effective.

- Termination Clause: Outlines the process for the payer to revoke or cancel the authorization.

- Signature and Date: The payer’s signature and the date of signing (or electronic equivalent).

- Notice of Varying Amounts: If the payment amount may vary, a clear explanation of how the payer will be notified of the changes.

Why EFT Authorization Agreements Matter Today

In today’s fast-paced digital economy, EFT authorization agreements are more important than ever. They provide a convenient and secure way for businesses to collect payments and for customers to manage their finances. The rise of subscription services and online commerce has further fueled the demand for EFT. Moreover, EFT reduces the risk of late payments, bounced checks, and other payment-related issues. Recent studies indicate a significant increase in EFT adoption among small businesses, highlighting its growing importance in the modern financial landscape.

ACH Payments: The Backbone of EFT

Automated Clearing House (ACH) payments form the core infrastructure for most electronic funds transfers in the United States. Understanding ACH is crucial to understanding EFT authorization agreements. The ACH network is a nationwide electronic funds transfer system that facilitates transactions between banks and credit unions. It’s governed by Nacha, formerly the National Automated Clearing House Association, which establishes the rules and standards for ACH payments.

How ACH Works with EFT Authorization Agreements

When a customer signs an electronic funds transfer (EFT) authorization agreement, they are essentially granting permission for the payee to initiate ACH debits from their bank account. The payee then submits the payment information to their bank, which forwards it to the ACH network. The ACH network processes the transaction and routes it to the payer’s bank, where the funds are debited from the customer’s account and credited to the payee’s account. The entire process typically takes one to two business days.

Key Benefits of Using ACH for EFT

- Lower Transaction Fees: ACH transactions generally have lower fees compared to credit card payments.

- Increased Security: ACH is a highly secure payment system with robust fraud prevention measures.

- Improved Cash Flow: EFT ensures timely payments, improving cash flow for businesses.

- Reduced Paperwork: Eliminates the need for paper checks, saving time and resources.

Creating a Compliant EFT Authorization Agreement: Best Practices

Creating a compliant and effective electronic funds transfer (EFT) authorization agreement requires careful attention to detail. Here are some best practices to follow:

Obtain Explicit Authorization

Ensure that the payer provides explicit authorization to debit their account. Avoid using vague or ambiguous language. The authorization clause should clearly state that the payer understands and agrees to the terms of the agreement. A pre-checked box is not sufficient; the payer must actively opt-in.

Provide Clear and Conspicuous Disclosures

Disclose all material terms of the agreement in a clear and conspicuous manner. This includes the payment amount, frequency, effective date, and termination clause. Use plain language that is easy for the average person to understand. Avoid using legal jargon or fine print.

Comply with E-SIGN Act Requirements

If you are obtaining electronic signatures, comply with the requirements of the Electronic Signatures in Global and National Commerce Act (E-SIGN Act). This includes providing the payer with a clear and conspicuous disclosure statement and obtaining their consent to receive documents electronically.

Maintain Accurate Records

Maintain accurate records of all electronic funds transfer (EFT) authorization agreements. This includes the original agreement, any amendments, and records of all transactions. Store these records securely and retain them for the required retention period (typically two years).

Provide a Copy to the Payer

Provide the payer with a copy of the electronic funds transfer (EFT) authorization agreement. This can be done electronically or in paper form. Ensure that the payer has access to the agreement for future reference.

Implement a Cancellation Process

Establish a clear and easy-to-use process for the payer to cancel the authorization. This should include providing a written notice of cancellation to the payee. The cancellation process should be clearly outlined in the electronic funds transfer (EFT) authorization agreement.

Regularly Review and Update Agreements

Regularly review and update your electronic funds transfer (EFT) authorization agreements to ensure they comply with current laws and regulations. This is especially important if there are changes to your business practices or the ACH rules.

Common Mistakes to Avoid in EFT Authorization Agreements

Even with careful planning, mistakes can happen. Here are some common pitfalls to avoid when creating electronic funds transfer (EFT) authorization agreements:

Using Vague or Ambiguous Language

Avoid using vague or ambiguous language in your agreement. Be specific about the payment amount, frequency, and other key terms. Ambiguity can lead to disputes and legal challenges.

Failing to Obtain Explicit Authorization

Always obtain explicit authorization from the payer. Do not assume that authorization is implied or that a pre-checked box is sufficient. The payer must actively opt-in to the agreement.

Neglecting to Provide Clear Disclosures

Provide clear and conspicuous disclosures of all material terms of the agreement. Do not hide important information in fine print or legal jargon.

Ignoring E-SIGN Act Requirements

If you are obtaining electronic signatures, comply with the requirements of the E-SIGN Act. Failure to do so can render your agreement unenforceable.

Failing to Maintain Accurate Records

Maintain accurate records of all electronic funds transfer (EFT) authorization agreements. This is essential for resolving disputes and demonstrating compliance with regulations.

Overlooking the Cancellation Process

Establish a clear and easy-to-use cancellation process. Failure to do so can lead to customer dissatisfaction and legal issues.

The Role of Technology in EFT Authorization Agreements

Technology plays a crucial role in simplifying and streamlining the electronic funds transfer (EFT) authorization process. Electronic signature platforms, online payment portals, and automated billing systems can help businesses create, manage, and track electronic funds transfer (EFT) authorization agreements more efficiently.

Electronic Signature Platforms

Electronic signature platforms allow you to obtain legally binding signatures online. These platforms comply with the requirements of the E-SIGN Act and provide a secure and convenient way for customers to sign electronic funds transfer (EFT) authorization agreements. Popular options include DocuSign and Adobe Sign.

Online Payment Portals

Online payment portals allow customers to authorize electronic funds transfer (EFT) payments directly through your website or mobile app. These portals often integrate with ACH payment processors and provide a seamless payment experience.

Automated Billing Systems

Automated billing systems automate the process of creating and sending invoices, collecting payments, and managing customer accounts. These systems can integrate with electronic funds transfer (EFT) authorization agreements to automate recurring payments.

Example EFT Authorization Agreement Template

[**Disclaimer:** This is a sample template for illustrative purposes only and should not be used as a substitute for legal advice. Consult with an attorney to ensure your agreement complies with applicable laws and regulations.]

**Electronic Funds Transfer (EFT) Authorization Agreement**

I, [Payer Name], authorize [Payee Name] to debit my account at [Bank Name] for payments as described below:

- Bank Account Number: [Account Number]

- Bank Routing Number: [Routing Number]

- Payment Amount: [Dollar Amount]

- Payment Frequency: [Monthly/Weekly/Other]

- Effective Date: [Date]

I understand that this authorization will remain in effect until I provide written notice of cancellation to [Payee Name]. I have the right to cancel this authorization at any time by providing written notice at least [Number] days prior to the next scheduled payment.

Signature: _________________________

Date: _________________________

The Future of EFT Authorization Agreements

The future of electronic funds transfer (EFT) authorization agreements is likely to be shaped by technological advancements and evolving consumer preferences. We can expect to see increased adoption of mobile payments, biometric authentication, and blockchain technology. These innovations will further streamline the payment process and enhance security.

Mobile Payments

Mobile payments are becoming increasingly popular, and we can expect to see more electronic funds transfer (EFT) authorization agreements integrated into mobile wallets and payment apps. This will allow customers to authorize payments directly from their smartphones or tablets.

Biometric Authentication

Biometric authentication, such as fingerprint scanning and facial recognition, can provide an extra layer of security for electronic funds transfer (EFT) authorization agreements. This technology can help prevent fraud and ensure that only authorized individuals can initiate payments.

Blockchain Technology

Blockchain technology has the potential to revolutionize the payment industry by providing a secure and transparent way to track transactions. We may see electronic funds transfer (EFT) authorization agreements stored on blockchain ledgers, making them more secure and tamper-proof.

Review of DocuSign for EFT Authorization Agreements

DocuSign is a leading electronic signature platform widely used for various document signing needs, including electronic funds transfer (EFT) authorization agreements. Here’s a detailed review:

User Experience & Usability

DocuSign boasts an intuitive and user-friendly interface. From the moment you upload a document to sending it out for signatures, the process is streamlined and easy to navigate. The drag-and-drop functionality for adding signature fields, dates, and other form elements is particularly helpful. In our experience, even users with limited technical skills can quickly learn to use DocuSign effectively.

Performance & Effectiveness

DocuSign delivers on its promise of secure and legally binding electronic signatures. The platform uses robust encryption and authentication methods to ensure the integrity of signed documents. We’ve found that documents signed through DocuSign are readily accepted by banks and other financial institutions.

Pros

- Ease of Use: Intuitive interface and drag-and-drop functionality.

- Legally Binding: Complies with the E-SIGN Act and other relevant regulations.

- Secure: Uses robust encryption and authentication methods.

- Integration: Integrates with various business applications.

- Mobile Access: Allows users to sign documents from anywhere.

Cons/Limitations

- Cost: DocuSign can be expensive for small businesses or individuals with limited needs.

- Learning Curve: While generally user-friendly, some advanced features may require a learning curve.

- Reliance on Internet: Requires a stable internet connection to use.

Ideal User Profile

DocuSign is best suited for businesses of all sizes that need to obtain electronic signatures on a regular basis. It is particularly useful for businesses that handle a lot of paperwork or that need to comply with strict regulatory requirements.

Key Alternatives

Adobe Sign is a strong alternative to DocuSign, offering similar features and functionality. HelloSign is another popular option, particularly for small businesses and startups.

Expert Overall Verdict & Recommendation

DocuSign is a reliable and feature-rich electronic signature platform that is well-suited for electronic funds transfer (EFT) authorization agreements. While it can be expensive, the benefits of ease of use, legal compliance, and security make it a worthwhile investment for many businesses. We highly recommend DocuSign for businesses that need to obtain electronic signatures on a regular basis.

Insightful Q&A Section

-

Question: What happens if a customer disputes an EFT transaction after signing an authorization agreement?

Answer: If a customer disputes an EFT transaction, the process typically involves contacting their bank and filing a dispute claim. The bank will then investigate the claim and may request documentation from both the customer and the business. The authorization agreement serves as crucial evidence in such disputes, demonstrating the customer’s prior consent to the transaction. Having a clear and well-documented agreement is paramount in resolving disputes efficiently.

-

Question: How often should I update my EFT authorization agreement template?

Answer: It’s advisable to review and update your EFT authorization agreement template at least annually, or whenever there are changes to relevant laws, regulations, or your business practices. Staying current with legal requirements and industry best practices helps ensure compliance and reduces the risk of legal challenges.

-

Question: Can I use a single EFT authorization agreement for multiple bank accounts of the same customer?

Answer: Generally, it’s best practice to have a separate EFT authorization agreement for each bank account. This ensures clarity and avoids potential confusion or disputes. Each agreement should clearly identify the specific bank account to be debited.

-

Question: What are the legal consequences of debiting a customer’s account without a valid EFT authorization agreement?

Answer: Debiting a customer’s account without a valid EFT authorization agreement can result in legal penalties, including fines, lawsuits, and reputational damage. It’s crucial to obtain proper authorization before initiating any EFT transactions.

-

Question: How can I ensure that my online EFT authorization process is secure?

Answer: To ensure the security of your online EFT authorization process, use a secure payment gateway, implement strong encryption protocols (such as SSL/TLS), and comply with PCI DSS standards. Additionally, use two-factor authentication and regularly monitor your systems for security vulnerabilities.

-

Question: What information should I include in the termination clause of my EFT authorization agreement?

Answer: The termination clause should clearly state how the customer can cancel the authorization, the required notice period (e.g., 30 days), and the method for providing notice (e.g., written notice, email). It should also specify when the cancellation will take effect.

-

Question: Are there any specific disclosures required for EFT authorization agreements in certain states?

Answer: Yes, some states may have specific disclosure requirements for EFT authorization agreements. It’s essential to consult with an attorney or legal expert to ensure that your agreement complies with all applicable state laws.

-

Question: Can I use a verbal agreement for EFT authorization?

Answer: While verbal agreements may be permissible in some limited circumstances, it’s generally not advisable to rely on them for EFT authorization. A written agreement provides clear documentation of the terms and conditions and is much easier to enforce in case of a dispute.

-

Question: What is the difference between a recurring EFT payment and a one-time EFT payment?

Answer: A recurring EFT payment is a payment that is automatically debited from a customer’s account on a regular basis (e.g., monthly, weekly). A one-time EFT payment is a payment that is debited from a customer’s account only once. Each type of payment requires a specific type of authorization.

-

Question: How do I handle situations where a customer’s bank account has insufficient funds for an EFT payment?

Answer: Your EFT authorization agreement should outline the procedures for handling insufficient funds situations. This may include charging a fee for returned payments, attempting to debit the account again at a later date, or suspending services until payment is received. Clearly communicate these procedures to the customer in advance.

Conclusion & Strategic Call to Action

Mastering the intricacies of the electronic funds transfer (EFT) authorization agreement is essential for businesses seeking to establish seamless and legally sound payment processes. By understanding the core components, adhering to best practices, and leveraging technology, you can create agreements that protect both your interests and those of your customers. Throughout this guide, we’ve emphasized the importance of clear communication, explicit authorization, and ongoing compliance. As the financial landscape continues to evolve, staying informed and proactive in your approach to EFT authorization will be key to your success.

The future of payments is undoubtedly electronic, and by implementing robust EFT authorization procedures, you’ll be well-positioned to thrive in this dynamic environment. Now, we encourage you to share your experiences with electronic funds transfer (EFT) authorization agreements in the comments below. What challenges have you faced, and what solutions have you found? Explore our advanced guide to ACH payment processing for even more in-depth information. And if you require personalized guidance, contact our experts for a consultation on electronic funds transfer (EFT) authorization agreements today.