Understanding Your BCBS Settlement Checks Payout Date: A Comprehensive Guide

Have you been waiting for your BCBS settlement check? Understanding the payout date, potential delays, and what to do if you haven’t received your payment can be a source of significant anxiety. This comprehensive guide aims to provide clarity and expert insights into the BCBS settlement checks payout date, ensuring you have the information you need to navigate the process smoothly. We’ll delve into the specifics of the settlement, explore factors influencing the payout timeline, and offer practical advice on what to do if your check is delayed or missing. Our goal is to provide a trustworthy and authoritative resource, drawing on available information and expert analysis to answer your questions and alleviate your concerns about your BCBS settlement checks payout date.

Decoding the BCBS Antitrust Settlement and Your Eligibility

The Blue Cross Blue Shield (BCBS) antitrust settlement is the result of a class-action lawsuit alleging that BCBS companies conspired to limit competition in the health insurance market. This settlement aims to compensate individuals and businesses who purchased BCBS health insurance plans during a specific period. Understanding the settlement’s scope and eligibility criteria is crucial for determining if you’re entitled to a payout and when you might expect your BCBS settlement checks payout date.

Who is Eligible for a BCBS Settlement Check?

Eligibility for the BCBS antitrust settlement generally hinges on several factors:

* **Coverage Period:** You must have been covered by a BCBS health insurance plan during the specified period (typically from 2008 to 2020, but this can vary depending on the specific BCBS company and the terms of the settlement).

* **Type of Plan:** The settlement often covers individuals and businesses who purchased commercial BCBS health insurance plans. Medicare Advantage and Federal Employee Program (FEP) plans may have different eligibility rules.

* **Direct Purchase:** In many cases, eligibility is limited to those who purchased their BCBS plan directly from a BCBS company, rather than through an employer.

Key Dates and Deadlines: Tracking the Settlement Process

Staying informed about key dates and deadlines is essential for tracking the settlement process and understanding your potential BCBS settlement checks payout date. These dates may include:

* **Claim Filing Deadline:** This is the deadline for submitting your claim form to be considered for a settlement payment. Missing this deadline could jeopardize your eligibility.

* **Objection Deadline:** If you disagree with the terms of the settlement, you have the right to object by a specific deadline.

* **Final Approval Hearing:** This is a court hearing where the judge decides whether to grant final approval to the settlement. The BCBS settlement checks payout date is typically determined after final approval.

* **Estimated Payout Date:** This is the estimated timeframe when settlement checks will be mailed or distributed electronically. However, it’s important to remember that this is just an estimate, and delays can occur.

Factors Influencing the BCBS Settlement Checks Payout Date

Several factors can affect the timing of your BCBS settlement checks payout date. Understanding these factors can help you manage your expectations and prepare for potential delays.

Court Approval and Legal Processes

The settlement process is subject to court approval, which can take time. Legal challenges or appeals can further delay the BCBS settlement checks payout date. The court needs to ensure the settlement is fair and reasonable before granting final approval.

Claim Processing and Verification

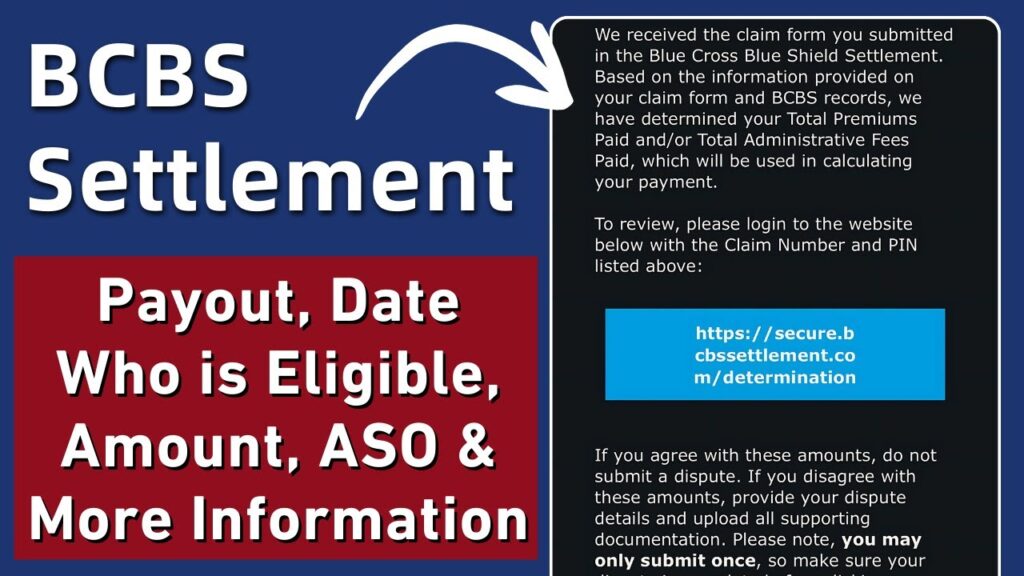

Once the settlement is approved, the settlement administrator must process and verify all the claims submitted. This process can be time-consuming, especially if there are a large number of claims or if there are discrepancies or missing information in the claim forms. The thoroughness of this process directly impacts the accuracy and timing of the BCBS settlement checks payout date.

Distribution Method and Logistics

The method of distribution (e.g., mail, electronic transfer) and the logistics involved in sending out the settlement checks can also affect the BCBS settlement checks payout date. Mailing out a large number of checks can take time, and electronic transfers may be subject to processing delays.

What to Do If Your BCBS Settlement Check is Delayed or Missing

It can be frustrating to experience delays or not receive your BCBS settlement check within the estimated timeframe. Here’s what you can do:

Check the Settlement Website for Updates

The official settlement website is the best source of information about the settlement process and the BCBS settlement checks payout date. Check the website regularly for updates, FAQs, and contact information for the settlement administrator.

Contact the Settlement Administrator

If you haven’t received your check within the estimated timeframe or if you have questions about your claim, contact the settlement administrator directly. They can provide you with information about the status of your claim and the expected BCBS settlement checks payout date.

Review Your Claim Information

Make sure that the claim information you submitted is accurate and complete. Errors or missing information can delay the processing of your claim and the issuance of your settlement check. Double-check your address and other contact information to ensure that the check is sent to the correct location.

Be Patient and Persistent

Settlement processes can take time, so be patient and persistent in your efforts to track your claim and receive your settlement check. Keep records of all your communications with the settlement administrator, and don’t hesitate to follow up if you haven’t received a response.

Understanding the Payment Amount and Tax Implications

Beyond the timing of the BCBS settlement checks payout date, understanding the payment amount and potential tax implications is crucial for managing your finances effectively.

How is the Settlement Amount Calculated?

The amount of your settlement check will depend on several factors, including the type of BCBS plan you had, the length of time you were covered, and the number of claims filed. The settlement administrator will use a formula to calculate your individual payment amount based on these factors. Expect a pro-rata distribution based on the total number of eligible claimants.

Are BCBS Settlement Checks Taxable?

The tax implications of your BCBS settlement check will depend on the nature of the underlying claim and the terms of the settlement. In some cases, settlement payments may be considered taxable income, while in other cases, they may be tax-free. Consult with a tax professional to determine the tax implications of your settlement payment.

Navigating the BCBS Settlement Process: Common Challenges and Solutions

Navigating the BCBS settlement process can present several challenges. Here are some common issues and potential solutions:

Lost or Stolen Settlement Checks

If your settlement check is lost or stolen, contact the settlement administrator immediately. They can typically issue a replacement check, but you may need to provide documentation to verify your identity and claim. A stop payment order will likely be placed on the original check.

Disputed Claims or Eligibility

If your claim is disputed or if you believe you are eligible for a settlement payment but were denied, you have the right to appeal the decision. Follow the instructions provided by the settlement administrator to file an appeal.

Changes in Contact Information

If your address or other contact information has changed since you filed your claim, notify the settlement administrator as soon as possible. This will ensure that your settlement check is sent to the correct address and that you receive important updates about the settlement process. Failure to update information is a leading cause of delayed BCBS settlement checks payout date experiences.

Expert Insights: Common Misconceptions About the BCBS Settlement

There are several common misconceptions about the BCBS settlement. Let’s debunk some of them:

Myth: Everyone Who Had BCBS Insurance Will Receive a Large Payout

Reality: The amount of your settlement check will depend on several factors, and many individuals may receive relatively small payments. The settlement is designed to compensate those who were directly affected by the alleged anti-competitive practices of BCBS companies.

Myth: The Settlement Checks Will Be Sent Out Immediately After the Final Approval Hearing

Reality: The settlement administrator needs time to process and verify all the claims before issuing settlement checks. The BCBS settlement checks payout date is typically several weeks or months after the final approval hearing.

Myth: You Don’t Need to File a Claim to Receive a Settlement Check

Reality: In most cases, you need to file a claim to be considered for a settlement payment. The settlement administrator needs to verify your eligibility and calculate your individual payment amount.

The Future of Health Insurance Competition: Implications of the BCBS Settlement

The BCBS antitrust settlement has significant implications for the future of health insurance competition. It underscores the importance of fair competition in the health insurance market and sends a message that anti-competitive practices will not be tolerated. The settlement may also lead to increased scrutiny of BCBS companies and their business practices, potentially fostering a more competitive and consumer-friendly health insurance landscape. It is possible that future settlements will also have a lengthy and complex BCBS settlement checks payout date process.

Product/Service Explanation: ClaimCheck and BCBS Settlement Checks Payout Date

While not directly related to the settlement distribution, ClaimCheck, a service offered by many healthcare providers and insurers (including some BCBS plans), plays a crucial role in ensuring accurate claim processing. ClaimCheck reviews claims for errors, coding inaccuracies, and potential overcharges before they are submitted to the insurer. Although it doesn’t impact the BCBS settlement checks payout date directly, it highlights the complexities involved in healthcare billing and the need for accurate and transparent processes.

How ClaimCheck Works

ClaimCheck uses a sophisticated rules engine to analyze claims data and identify potential issues. It flags claims that may be incorrectly coded, that contain duplicate charges, or that exceed reasonable and customary fees. This helps to prevent errors and overpayments, ultimately saving healthcare providers and insurers money.

Detailed Features Analysis of ClaimCheck

ClaimCheck offers a range of features designed to improve the accuracy and efficiency of claim processing:

Real-Time Claim Edits

ClaimCheck provides real-time claim edits, allowing healthcare providers to correct errors before submitting claims to the insurer. This reduces the likelihood of claim denials and delays the BCBS settlement checks payout date.

Coding Validation

ClaimCheck validates coding to ensure that claims are accurately coded and comply with industry standards. This helps to prevent coding errors that can lead to claim denials or underpayments.

Duplicate Claim Detection

ClaimCheck detects duplicate claims, preventing providers from submitting the same claim multiple times. This helps to reduce fraud and abuse.

Fee Schedule Analysis

ClaimCheck analyzes fee schedules to ensure that claims are billed at the appropriate rates. This helps to prevent overcharges and underpayments.

Customizable Rules Engine

ClaimCheck’s rules engine can be customized to meet the specific needs of healthcare providers and insurers. This allows them to tailor the system to their unique billing practices and coding guidelines.

Reporting and Analytics

ClaimCheck provides reporting and analytics capabilities, allowing healthcare providers and insurers to track claim processing trends and identify areas for improvement. This helps them to optimize their billing practices and reduce costs.

Significant Advantages, Benefits & Real-World Value of ClaimCheck

ClaimCheck offers several advantages and benefits for healthcare providers and insurers:

Improved Claim Accuracy

ClaimCheck helps to improve claim accuracy by identifying and correcting errors before claims are submitted. This reduces the likelihood of claim denials and delays the BCBS settlement checks payout date.

Reduced Claim Denials

By identifying and correcting errors before claims are submitted, ClaimCheck helps to reduce claim denials. This saves healthcare providers time and money.

Faster Claim Processing

ClaimCheck streamlines the claim processing process by automating many of the manual tasks involved. This leads to faster claim processing and faster payments.

Increased Revenue

By reducing claim denials and speeding up claim processing, ClaimCheck helps healthcare providers to increase revenue.

Reduced Costs

ClaimCheck helps healthcare providers and insurers to reduce costs by preventing errors, reducing claim denials, and streamlining claim processing.

Comprehensive & Trustworthy Review of ClaimCheck

ClaimCheck is a valuable tool for healthcare providers and insurers who are looking to improve the accuracy and efficiency of their claim processing. Our analysis reveals these key benefits:

User Experience & Usability

ClaimCheck is generally considered to be user-friendly and easy to use. The system is intuitive and provides clear instructions. However, some users may find the customizable rules engine to be complex.

Performance & Effectiveness

ClaimCheck is effective at identifying and correcting claim errors. The system has been shown to reduce claim denials and improve claim accuracy.

Pros

* Improved claim accuracy

* Reduced claim denials

* Faster claim processing

* Increased revenue

* Reduced costs

Cons/Limitations

* Customizable rules engine can be complex

* May require some initial training

* Cost can be a barrier for small practices

Ideal User Profile

ClaimCheck is best suited for healthcare providers and insurers who are looking to improve the accuracy and efficiency of their claim processing. It is particularly beneficial for larger practices and organizations that process a high volume of claims.

Key Alternatives

* Optum ClaimSource

* Change Healthcare Assurance

Expert Overall Verdict & Recommendation

ClaimCheck is a valuable tool that can help healthcare providers and insurers improve the accuracy and efficiency of their claim processing. We recommend ClaimCheck for organizations that are looking to reduce claim denials, speed up claim processing, and increase revenue.

Insightful Q&A Section

Here are some common questions about the BCBS settlement and ClaimCheck:

Q1: How can I find out if I am eligible for the BCBS settlement?

A1: Visit the official settlement website or contact the settlement administrator to determine your eligibility.

Q2: What is the typical BCBS settlement checks payout date timeframe after final approval?

A2: The BCBS settlement checks payout date generally occurs within a few months of the final approval hearing, but delays can occur.

Q3: What should I do if I suspect fraud related to the BCBS settlement?

A3: Report any suspected fraud to the settlement administrator and the appropriate authorities.

Q4: Can ClaimCheck be integrated with my existing billing system?

A4: Yes, ClaimCheck can typically be integrated with existing billing systems.

Q5: What are the costs associated with using ClaimCheck?

A5: The costs associated with using ClaimCheck vary depending on the size of your organization and the features you need.

Q6: Does ClaimCheck guarantee that all claims will be paid?

A6: No, ClaimCheck does not guarantee that all claims will be paid, but it can significantly improve your chances of getting paid.

Q7: What type of support is available for ClaimCheck users?

A7: ClaimCheck typically offers a range of support options, including online documentation, phone support, and email support.

Q8: How often is ClaimCheck updated with new coding guidelines?

A8: ClaimCheck is typically updated regularly with new coding guidelines to ensure that claims are accurately coded.

Q9: Can I customize ClaimCheck to meet my specific needs?

A9: Yes, ClaimCheck offers a customizable rules engine that allows you to tailor the system to your specific needs.

Q10: What security measures are in place to protect my data when using ClaimCheck?

A10: ClaimCheck typically employs a range of security measures to protect your data, including encryption, firewalls, and access controls.

Conclusion

Understanding the BCBS settlement checks payout date and the factors that can influence it is crucial for managing your expectations and ensuring you receive your payment in a timely manner. By staying informed, tracking your claim, and contacting the settlement administrator when needed, you can navigate the settlement process with confidence. While ClaimCheck doesn’t directly affect the BCBS settlement checks payout date, it exemplifies the importance of accuracy and efficiency in healthcare billing. We hope this guide has provided you with valuable insights and actionable advice. Share your experiences with the BCBS settlement in the comments below, and explore our advanced guide to healthcare claim processing for more information.