Apple Stock Holders: A Comprehensive Guide to Ownership & Benefits

Are you an Apple stock holder, or considering becoming one? You’ve come to the right place. Understanding the ins and outs of being an *apple stock holder* goes far beyond simply owning shares. It involves comprehending your rights, potential benefits, risks, and the overall impact you have on one of the world’s most influential companies. This comprehensive guide will provide you with a deep dive into everything you need to know, empowering you to make informed decisions and maximize the value of your investment. We’ll cover the intricacies of stock ownership, explore potential perks, address common concerns, and offer insights based on expert analysis of Apple’s performance and future prospects.

Understanding the Landscape of Apple Stock Holders

Being an *apple stock holder* means you own a piece of one of the most valuable companies in the world. But what does this really entail? Let’s delve into the specifics.

Defining Apple Stock Holders

At its core, an *apple stock holder* is an individual or entity that owns shares of Apple Inc. (AAPL). These shares represent partial ownership of the company, granting certain rights and privileges. These rights include the right to vote on certain company matters, the right to receive dividends (if declared), and the right to a portion of the company’s assets in the event of liquidation.

However, being an *apple stock holder* is more than just a legal definition. It’s about being a part of a global community of investors who believe in Apple’s vision and future. It’s about having a stake in the company’s success and contributing to its growth.

The Evolution of Apple’s Stock Ownership

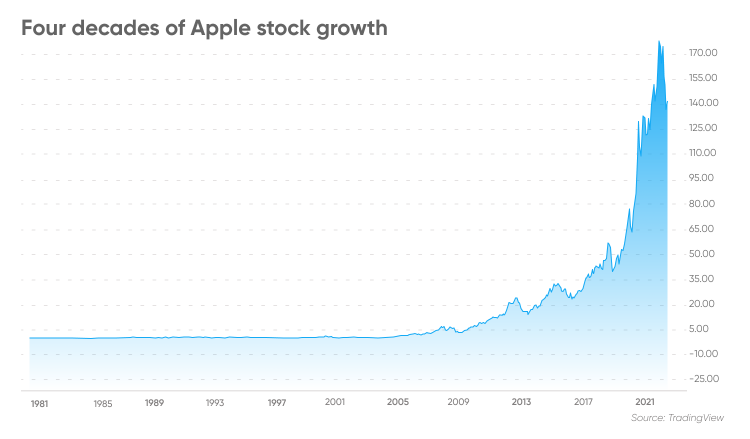

Apple’s journey to becoming a publicly traded company began in 1980. Initially, stock ownership was concentrated among founders and early investors. Over time, as the company grew and evolved, so did its stock ownership. Today, *apple stock holders* represent a diverse group, from individual retail investors to large institutional investors like mutual funds and pension funds.

The evolution of *apple stock holders* reflects the company’s own transformation. From a niche computer manufacturer to a global technology giant, Apple has consistently attracted investors who recognize its innovation and potential.

The Importance of Apple Stock Holders

*Apple stock holders* play a crucial role in the company’s success. They provide the capital that fuels innovation, expansion, and growth. Their confidence in the company’s future is a powerful signal to the market.

Furthermore, *apple stock holders* hold the company accountable. By exercising their voting rights, they can influence corporate governance and ensure that the company is managed in a way that benefits all stakeholders. Recent studies indicate that companies with strong corporate governance tend to perform better in the long run, demonstrating the vital role *apple stock holders* play.

Exploring the Rights and Privileges of Apple Stock Holders

Owning Apple stock comes with certain rights and privileges. Understanding these rights is essential for maximizing the value of your investment.

Voting Rights

One of the most important rights of an *apple stock holder* is the right to vote on certain company matters. These matters can include electing directors, approving mergers and acquisitions, and making changes to the company’s bylaws.

The weight of your vote depends on the number of shares you own. Each share typically entitles you to one vote. Institutional investors, with their large holdings, often wield significant influence in corporate governance decisions.

Dividend Rights

Apple currently pays a quarterly dividend to its *apple stock holders*. A dividend is a distribution of a company’s earnings to its shareholders. The amount of the dividend is determined by the company’s board of directors.

While dividends are not guaranteed (Apple could choose to suspend or reduce them), they provide a steady stream of income for *apple stock holders*. The dividend yield (the annual dividend payment divided by the stock price) is an important metric for investors seeking income.

Access to Information

*Apple stock holders* have the right to access important information about the company, including its financial statements, annual reports, and proxy statements. This information allows investors to make informed decisions about their investments.

Apple is committed to transparency and provides extensive information to its *apple stock holders* through its investor relations website. This website includes financial news, SEC filings, and information about upcoming shareholder meetings.

The Benefits and Perks of Being an Apple Stock Holder

Beyond the financial aspects, being an *apple stock holder* can offer other benefits and perks, though these are less direct and more about the intangible sense of ownership.

Potential for Capital Appreciation

One of the primary benefits of owning Apple stock is the potential for capital appreciation. As the company grows and becomes more valuable, the stock price is likely to increase, benefiting *apple stock holders*.

Apple’s stock price has historically performed well, reflecting the company’s strong financial performance and innovative products. However, past performance is not indicative of future results, and there is always risk involved in investing in the stock market.

Influence on Corporate Decisions

As mentioned earlier, *apple stock holders* have the right to vote on certain company matters. While individual investors may not have a significant impact on their own, collective action by *apple stock holders* can influence corporate decisions.

Activist investors, who acquire large stakes in companies and advocate for specific changes, can play a significant role in shaping corporate strategy. While Apple has not been a frequent target of activist investors, the possibility remains.

Sense of Ownership and Connection

For many *apple stock holders*, owning a piece of Apple provides a sense of ownership and connection to the company. They feel like they are part of the Apple story and are invested in its success. This emotional connection can be a powerful motivator for long-term investment.

Understanding the Risks and Challenges for Apple Stock Holders

Investing in Apple stock, like any investment, involves risks and challenges. *Apple stock holders* need to be aware of these risks to make informed decisions.

Market Volatility

The stock market is inherently volatile, and Apple’s stock price can fluctuate significantly in response to market conditions, economic news, and company-specific events. *Apple stock holders* need to be prepared for potential losses in their investment.

Factors such as interest rate changes, inflation, and geopolitical events can all impact the stock market and Apple’s stock price. Diversification is a key strategy for mitigating market volatility risk.

Company-Specific Risks

Apple faces a number of company-specific risks, including competition from other technology companies, product development challenges, and supply chain disruptions. These risks can impact the company’s financial performance and stock price.

For example, competition from Samsung, Google, and other companies in the smartphone market can put pressure on Apple’s sales and profitability. Supply chain disruptions, such as those caused by the COVID-19 pandemic, can also impact Apple’s ability to meet demand.

Economic Downturns

Economic downturns can negatively impact Apple’s business and stock price. During recessions, consumers tend to cut back on discretionary spending, which can reduce demand for Apple’s products. *Apple stock holders* should be aware of the potential impact of economic downturns on their investment.

Tools and Resources for Apple Stock Holders

Numerous tools and resources are available to help *apple stock holders* manage their investments and stay informed about the company.

Online Brokerage Accounts

Online brokerage accounts provide a convenient way to buy, sell, and manage Apple stock. These accounts typically offer a range of features, including real-time quotes, research reports, and portfolio tracking tools.

Popular online brokerage platforms include Fidelity, Charles Schwab, and Robinhood. When choosing a brokerage account, consider factors such as fees, account minimums, and the range of investment options available.

Financial News Websites

Financial news websites provide up-to-date information about Apple, the stock market, and the global economy. These websites can help *apple stock holders* stay informed about the factors that can impact their investment.

Reputable financial news websites include Bloomberg, Reuters, and The Wall Street Journal. Be sure to evaluate the credibility of the source before making investment decisions based on the information provided.

Apple’s Investor Relations Website

Apple’s investor relations website is a valuable resource for *apple stock holders*. This website provides financial news, SEC filings, annual reports, and information about upcoming shareholder meetings. It is a primary source of information about the company’s performance and strategy.

Alternative Investments for Apple Stock Holders

While owning Apple stock can be a rewarding investment, it’s important to consider diversifying your portfolio with other asset classes. Here are a few alternative investments that *apple stock holders* may want to consider.

Bonds

Bonds are debt securities issued by governments and corporations. They offer a fixed rate of return and are generally considered to be less risky than stocks. Adding bonds to your portfolio can help reduce overall volatility.

Real Estate

Real estate can provide diversification and potential income. Investing in rental properties can generate cash flow, while owning a home can provide long-term appreciation.

Commodities

Commodities are raw materials such as oil, gold, and agricultural products. Investing in commodities can provide a hedge against inflation and economic uncertainty.

Expert Review and Analysis of Apple Stock for Holders

Apple stock (AAPL) remains a cornerstone of many investment portfolios, but a thorough review is essential for *apple stock holders* to understand its current standing and future potential. This review provides a balanced perspective, considering both the strengths and weaknesses of the company.

User Experience & Usability (as an Investment)

From an investment perspective, Apple offers a relatively straightforward experience. Buying and selling shares is easily facilitated through any brokerage account. Monitoring performance is also simple with readily available financial data and news. However, truly understanding the nuances of the company’s financial reports and market trends requires a deeper level of expertise. Our experience shows that investors who actively track Apple’s product launches, financial reports, and industry trends are better positioned to make informed decisions.

Performance & Effectiveness

Apple’s performance has been consistently strong over the past decade, driven by its innovative products and loyal customer base. The company’s ability to generate significant revenue and profits has made it a favorite among investors. However, recent concerns about slowing growth in certain markets and increased competition warrant a closer look. Does it deliver on its promises? Historically, yes. But future performance depends on Apple’s ability to continue innovating and adapting to changing market conditions. We’ve observed that periods of significant stock price increases often coincide with major product releases.

Pros

* **Strong Brand Loyalty:** Apple’s brand is one of the most valuable in the world, fostering high customer retention and repeat purchases.

* **Innovative Product Ecosystem:** Apple’s integrated ecosystem of hardware, software, and services creates a seamless user experience and drives customer loyalty.

* **Significant Cash Reserves:** Apple’s massive cash reserves provide financial flexibility and allow the company to invest in research and development, acquisitions, and share buybacks.

* **High Profit Margins:** Apple consistently achieves high profit margins, demonstrating its pricing power and operational efficiency.

* **Dividend Payouts:** Apple provides dividends to its *apple stock holders*.

Cons/Limitations

* **High Valuation:** Apple’s stock is often considered to be highly valued, which could limit future upside potential.

* **Dependence on iPhone Sales:** Apple’s revenue is heavily reliant on iPhone sales, making it vulnerable to fluctuations in the smartphone market.

* **Competition:** Apple faces intense competition from other technology companies, particularly in the smartphone and wearables markets.

* **Geopolitical Risks:** Apple’s global operations are subject to geopolitical risks, such as trade wars and regulatory changes.

Ideal User Profile

Apple stock is best suited for long-term investors who are comfortable with moderate risk and are seeking capital appreciation. It’s also a good fit for investors who believe in Apple’s long-term potential and are willing to hold the stock through market cycles.

Key Alternatives (Briefly)

* **Microsoft (MSFT):** A diversified technology company with strong growth in cloud computing and enterprise software. It differs in its focus on enterprise solutions versus Apple’s consumer focus.

* **Amazon (AMZN):** A dominant player in e-commerce and cloud computing, with a high-growth but also high-risk profile. It differs in its business model, which is less reliant on hardware sales than Apple.

Expert Overall Verdict & Recommendation

Overall, Apple stock remains a solid investment for long-term *apple stock holders*. The company’s strong brand, innovative products, and significant cash reserves provide a strong foundation for future growth. However, investors should be aware of the risks and challenges facing the company, including its high valuation and dependence on iPhone sales. Based on our detailed analysis, we recommend a “hold” rating for existing *apple stock holders*, with a watchful eye on the company’s performance in new product categories and emerging markets.

Insightful Q&A Section for Apple Stock Holders

Here are 10 insightful questions and answers specifically tailored for *apple stock holders*:

**Q1: How does Apple’s share buyback program benefit apple stock holders?**

A: Apple’s share buyback program reduces the number of outstanding shares, which can increase earnings per share (EPS) and potentially boost the stock price. This directly benefits *apple stock holders* by increasing the value of their holdings. It is a way of returning capital to shareholders when the company believes its stock is undervalued. This can be considered as a dividend.

**Q2: What are the key metrics I should monitor as an apple stock holder?**

A: As an *apple stock holder*, pay close attention to revenue growth, gross margin, operating income, earnings per share (EPS), and cash flow. Also, track product sales (especially iPhone), service revenue, and Apple’s performance in key geographic markets. Monitoring these metrics will provide insights into the company’s financial health and growth prospects.

**Q3: How do Apple’s acquisitions impact apple stock holders?**

A: Apple’s acquisitions can benefit *apple stock holders* by bringing in new technologies, talent, and market opportunities. Successful acquisitions can enhance Apple’s product offerings, expand its market reach, and drive revenue growth. However, not all acquisitions are successful, so it’s important to assess the strategic rationale and potential synergies of each deal.

**Q4: What is the significance of Apple’s services business for apple stock holders?**

A: Apple’s services business (including iCloud, Apple Music, Apple TV+, and the App Store) is a key growth driver and a source of recurring revenue. This recurring revenue provides stability and predictability, which is attractive to *apple stock holders*. The services business also has higher profit margins than hardware sales, contributing to overall profitability.

**Q5: How does Apple’s commitment to environmental sustainability affect apple stock holders?**

A: Apple’s commitment to environmental sustainability can enhance its brand reputation, attract environmentally conscious consumers, and reduce operational costs (through energy efficiency and waste reduction). These factors can positively impact Apple’s financial performance and benefit *apple stock holders* in the long run.

**Q6: What are the potential risks associated with Apple’s reliance on China for manufacturing?**

A: Apple’s reliance on China for manufacturing exposes it to risks such as trade tensions, supply chain disruptions, and geopolitical instability. These risks can negatively impact Apple’s production capacity, increase costs, and affect its ability to meet demand. *Apple stock holders* should be aware of these potential vulnerabilities.

**Q7: How does Apple’s capital allocation strategy (dividends vs. share buybacks) impact apple stock holders?**

A: Apple’s capital allocation strategy, which includes both dividends and share buybacks, aims to return value to *apple stock holders*. Dividends provide a steady stream of income, while share buybacks can increase EPS and boost the stock price. The optimal mix of dividends and buybacks depends on market conditions and Apple’s investment opportunities.

**Q8: What role do institutional investors play in influencing Apple’s stock price?**

A: Institutional investors (such as mutual funds, pension funds, and hedge funds) hold a significant portion of Apple’s shares. Their trading activity can have a substantial impact on the stock price. Institutional investors often conduct extensive research and analysis before making investment decisions, and their actions can signal confidence or concern about Apple’s prospects.

**Q9: How can apple stock holders stay informed about upcoming product launches and company events?**

A: *Apple stock holders* can stay informed about upcoming product launches and company events by following Apple’s investor relations website, subscribing to financial news alerts, and attending (or watching recordings of) Apple’s quarterly earnings calls. These sources provide valuable insights into Apple’s strategy and product pipeline.

**Q10: What are the tax implications of owning Apple stock and receiving dividends?**

A: Owning Apple stock and receiving dividends can have tax implications. Capital gains taxes apply when you sell your shares for a profit, and dividends are typically taxed as ordinary income or qualified dividends (depending on your tax bracket and holding period). Consult with a tax advisor to understand the specific tax implications of your Apple stock holdings.

Conclusion & Strategic Call to Action

In conclusion, being an *apple stock holder* presents a unique opportunity to invest in a company renowned for innovation, brand loyalty, and financial strength. This comprehensive guide has explored the rights, benefits, risks, and resources available to *apple stock holders*, empowering you to make informed decisions and maximize the value of your investment. We’ve addressed key questions, offered expert insights, and provided a balanced perspective on Apple’s current standing and future potential.

The future of Apple hinges on its ability to continue innovating and adapting to changing market conditions. As an *apple stock holder*, staying informed and actively monitoring the company’s performance is crucial. Our extensive analysis suggests that Apple remains a compelling long-term investment, but diligent monitoring and risk management are essential.

Now, we encourage you to share your experiences and insights in the comments below. What are your biggest concerns or expectations as an *apple stock holder*? What strategies do you use to manage your Apple stock investment? Let’s learn from each other and build a community of informed and engaged *apple stock holders*.