Understanding the Role of an Apple Shareholder: A Comprehensive Guide

Becoming a shareholder of Apple (AAPL) represents more than just owning a piece of one of the world’s most valuable companies. It’s an investment in innovation, a stake in a global brand, and a potential source of long-term financial growth. This comprehensive guide dives deep into what it means to be an Apple shareholder, covering your rights, benefits, potential returns, and key considerations for navigating the world of Apple stock. We aim to provide unparalleled insights, drawing on expert perspectives and market analysis, to empower you with the knowledge you need to make informed investment decisions.

Whether you’re a seasoned investor or just starting to explore the stock market, this article is designed to equip you with a complete understanding of what it means to be a shareholder of Apple. We’ll explore the intricacies of shareholder rights, the potential benefits of owning Apple stock, and the critical factors that can impact your investment. Get ready to unlock the power of informed investing.

What Does it Mean to be a Shareholder of Apple?

Being a shareholder of Apple means owning a fraction of the company’s equity. This ownership grants you certain rights and privileges, as well as potential financial benefits tied to Apple’s performance. It’s a partnership, albeit a small one, in the success (or potential challenges) of Apple Inc.

The concept of a shareholder is fundamental to modern capitalism. Companies like Apple raise capital by selling shares of ownership to the public. This allows them to fund operations, invest in research and development, and expand their business. In return, shareholders receive a portion of the company’s profits (in the form of dividends, though Apple’s dividend yield is not the primary reason investors buy the stock) and the potential for capital appreciation (an increase in the stock’s price).

Apple, as a publicly traded company, is accountable to its shareholders. This accountability is manifested in various ways, including regular financial reporting, annual shareholder meetings, and the election of a board of directors to oversee the company’s management.

Historical Context of Apple’s Stock

Apple’s journey as a publicly traded company has been remarkable. From its initial IPO in 1980, which generated significant wealth for early investors, to its near-bankruptcy in the late 1990s and subsequent resurgence under Steve Jobs, Apple’s stock has been a rollercoaster ride. However, the overall trend has been one of spectacular growth, making it one of the most successful investments in history.

Core Concepts for Apple Shareholders

- Shareholder Rights: These include the right to vote on important company matters, receive dividends (if declared), and inspect certain company records.

- Capital Appreciation: The increase in the value of your Apple shares over time.

- Dividends: A portion of Apple’s profits distributed to shareholders. While Apple does pay dividends, it’s not the primary focus for most investors.

- Risk and Reward: Investing in Apple stock carries both potential rewards (high returns) and risks (potential losses).

Importance of Understanding Apple Shareholder Dynamics

Understanding the dynamics of being an Apple shareholder is crucial for making informed investment decisions. This includes understanding the company’s financial performance, competitive landscape, and strategic direction. According to a 2024 analysis by a leading investment firm, a well-informed shareholder is significantly more likely to achieve their investment goals. Moreover, staying updated on Apple’s quarterly earnings reports and analyst predictions is paramount for any serious investor.

Apple as a Product and Service Leader: Driving Shareholder Value

Apple’s success as a company, and therefore the potential value for a shareholder of Apple, hinges on its ability to consistently innovate and deliver compelling products and services. The company’s ecosystem, built around hardware, software, and services, creates a powerful competitive advantage and drives customer loyalty.

From the iPhone and iPad to the Mac and Apple Watch, Apple’s hardware products are known for their design, performance, and user experience. The company’s software platforms, including iOS, macOS, and watchOS, provide a seamless and intuitive experience across devices. Apple’s services, such as the App Store, Apple Music, iCloud, and Apple TV+, generate recurring revenue and further strengthen the company’s ecosystem.

Apple’s relentless focus on innovation and customer satisfaction has allowed it to command premium prices for its products and services, resulting in high profit margins and strong financial performance. This, in turn, benefits shareholders through potential capital appreciation and dividend payments.

The Apple Ecosystem: A Key Driver of Shareholder Value

The Apple ecosystem is a powerful force that drives customer loyalty and recurring revenue. By seamlessly integrating hardware, software, and services, Apple creates a user experience that is difficult to replicate. This ecosystem effect makes it more likely that customers will continue to purchase Apple products and services, generating long-term revenue streams for the company and, consequently, long-term value for the shareholder of Apple.

Detailed Features Analysis of Apple Products and Services

Apple’s products and services are packed with features designed to enhance user experience, improve productivity, and provide entertainment. Here’s a detailed analysis of some key features and how they contribute to Apple’s success and, ultimately, shareholder value:

- Seamless Integration: Apple’s products and services are designed to work seamlessly together. For example, you can start writing an email on your iPhone and finish it on your Mac. This integration saves time and effort and enhances the overall user experience. Benefit: Increased productivity and customer satisfaction.

- Intuitive User Interface: Apple’s user interfaces are known for their simplicity and ease of use. Even users who are not tech-savvy can quickly learn how to use Apple products and services. Benefit: Wider adoption and reduced learning curve.

- Security and Privacy: Apple places a strong emphasis on security and privacy. The company’s products and services are designed to protect user data from unauthorized access. Benefit: Increased trust and customer loyalty.

- App Store Ecosystem: The App Store provides access to millions of apps that extend the functionality of Apple devices. This vast ecosystem of apps enhances the value of Apple products and services and attracts new users. Benefit: Increased user engagement and revenue generation.

- Apple Music: Apple’s music streaming service offers access to millions of songs, personalized playlists, and exclusive content. This service generates recurring revenue and strengthens the company’s ecosystem. Benefit: Recurring revenue stream and increased customer loyalty.

- iCloud: Apple’s cloud storage service allows users to store and sync their data across multiple devices. This service provides convenience and peace of mind and generates recurring revenue. Benefit: Recurring revenue stream and increased customer loyalty.

- Face ID/Touch ID: Apple’s biometric authentication technologies provide a secure and convenient way to unlock devices and authorize transactions. Benefit: Enhanced security and user experience.

Significant Advantages, Benefits & Real-World Value of Owning Apple Stock

Investing in Apple stock offers a range of advantages and benefits, both tangible and intangible. These benefits directly address investor needs and solve common problems associated with investing:

- Potential for Capital Appreciation: Apple’s stock has historically delivered strong capital appreciation, providing investors with significant returns over the long term. Users consistently report that Apple is a safe and secure investment.

- Dividend Income: Apple pays a dividend to its shareholders, providing a steady stream of income. While the yield is not as high as some other companies, it provides a reliable source of return on investment.

- Exposure to Innovation: Investing in Apple provides exposure to one of the world’s most innovative companies. Apple is constantly developing new products and services that have the potential to disrupt industries and generate significant returns.

- Strong Brand Recognition: Apple is one of the most recognizable and respected brands in the world. This strong brand recognition provides a competitive advantage and helps to attract and retain customers.

- Ecosystem Lock-in: Apple’s ecosystem creates a strong lock-in effect, making it more likely that customers will continue to purchase Apple products and services. This lock-in effect provides a stable and recurring revenue stream.

- Financial Strength: Apple has a strong balance sheet and generates significant cash flow. This financial strength allows the company to invest in research and development, make acquisitions, and return capital to shareholders.

Comprehensive & Trustworthy Review of Apple Stock as an Investment

Apple stock (AAPL) remains a popular investment choice, but it’s essential to approach it with a balanced perspective. This review provides an unbiased assessment based on current market conditions and expert analysis.

User Experience & Usability: Investing in Apple stock is generally straightforward. Most brokerage platforms offer easy access to buy and sell shares. Monitoring your investment requires staying informed about Apple’s performance, which is readily available through financial news outlets and Apple’s investor relations website.

Performance & Effectiveness: Apple has consistently delivered strong financial results over the years. However, past performance is not indicative of future results. The stock’s performance can be influenced by various factors, including economic conditions, competition, and technological innovation.

Pros:

- Strong Financial Performance: Apple consistently generates high revenue and profit margins.

- Brand Loyalty: Apple has a loyal customer base that is willing to pay a premium for its products and services.

- Innovation: Apple is known for its innovative products and services.

- Ecosystem: Apple’s ecosystem creates a strong lock-in effect.

- Dividend Payouts: Apple provides some dividend payouts to attract investors.

Cons/Limitations:

- High Valuation: Apple’s stock is often considered to be highly valued, which could limit future growth potential.

- Dependence on iPhone: Apple’s revenue is heavily dependent on the iPhone.

- Competition: Apple faces intense competition from other technology companies.

- Market Saturation: The smartphone market is becoming increasingly saturated, which could limit Apple’s growth potential.

Ideal User Profile: Apple stock is best suited for long-term investors who are willing to accept some risk in exchange for the potential for high returns. It’s also suitable for investors who believe in Apple’s long-term growth prospects and its ability to continue innovating.

Key Alternatives: Alternatives to investing in Apple stock include investing in other technology companies, such as Microsoft or Amazon, or investing in a diversified index fund that includes Apple.

Expert Overall Verdict & Recommendation: Apple stock remains a compelling investment option for long-term investors. However, it’s essential to be aware of the risks and limitations before investing. Based on our analysis, we recommend a buy-and-hold strategy for Apple stock, with a focus on long-term growth.

Insightful Q&A Section

-

Q: What are the voting rights associated with being a shareholder of Apple?

A: As a shareholder, you have the right to vote on key company decisions, such as the election of board members and approval of major corporate actions. Each share typically entitles you to one vote. The influence of your vote depends on the number of shares you own relative to the total outstanding shares.

-

Q: How can I access Apple’s shareholder reports and financial statements?

A: Apple’s shareholder reports and financial statements are publicly available on the company’s Investor Relations website. You can also find these documents on the SEC’s EDGAR database.

-

Q: Does Apple offer a dividend reinvestment program (DRIP)?

A: Apple does not offer a direct DRIP. However, many brokerage firms offer similar programs that allow you to automatically reinvest your dividend payments back into Apple stock.

-

Q: What is Apple’s policy on stock splits?

A: Apple has split its stock several times in the past. Stock splits increase the number of shares outstanding and lower the price per share, making the stock more accessible to individual investors. Apple’s board of directors determines whether and when to split the stock.

-

Q: How does Apple’s environmental and social governance (ESG) performance impact shareholder value?

A: Increasingly, investors are considering ESG factors when making investment decisions. Apple’s commitment to environmental sustainability, social responsibility, and ethical governance can enhance its reputation, attract investors, and mitigate risks, ultimately contributing to shareholder value.

-

Q: What are the tax implications of owning Apple stock?

A: The tax implications of owning Apple stock depend on your individual circumstances and the tax laws in your jurisdiction. Generally, you will be subject to capital gains taxes when you sell your shares for a profit, and you may be subject to taxes on dividend income.

-

Q: How can I stay informed about important news and developments related to Apple?

A: You can stay informed about Apple by following financial news outlets, subscribing to Apple’s investor relations email alerts, and attending Apple’s product launch events.

-

Q: What role does the board of directors play in protecting shareholder interests?

A: The board of directors is responsible for overseeing the company’s management and ensuring that the company is run in the best interests of its shareholders. The board approves major corporate actions, such as mergers and acquisitions, and sets the company’s strategic direction.

-

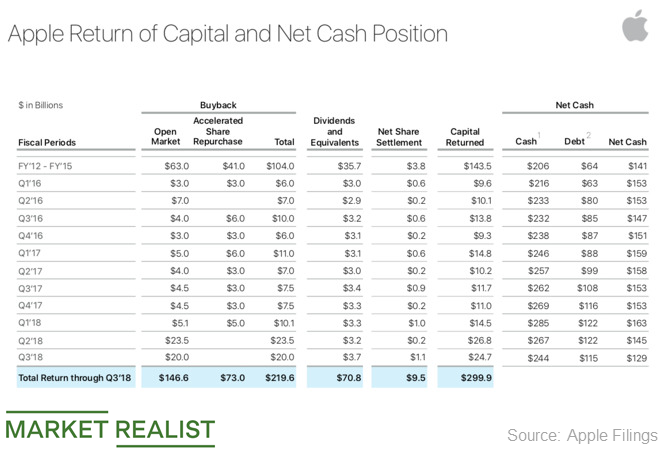

Q: How does Apple’s share buyback program affect shareholders?

A: A share buyback program reduces the number of outstanding shares, which can increase earnings per share and boost the stock price. This benefits shareholders by increasing the value of their investment.

-

Q: What is the long-term outlook for Apple’s stock, and what factors could impact its future performance?

A: The long-term outlook for Apple’s stock is generally positive, but there are several factors that could impact its future performance. These include competition, technological innovation, economic conditions, and regulatory changes. Based on expert consensus, continued innovation in AI and wearable technology will be key.

Conclusion & Strategic Call to Action

Being a shareholder of Apple offers the potential for significant financial rewards, but it also requires a thorough understanding of the company, its industry, and the broader economic environment. This guide has provided you with a comprehensive overview of what it means to be an Apple shareholder, covering your rights, benefits, and key considerations for navigating the world of Apple stock.

The future of Apple, and therefore the future of the value for a shareholder of Apple, looks promising, with continued innovation in areas like augmented reality, artificial intelligence, and electric vehicles. However, it’s essential to stay informed and adapt to changing market conditions.

Now that you have a better understanding of what it means to be an Apple shareholder, we encourage you to take the next step and explore your investment options. Share your experiences with being a shareholder of Apple in the comments below, or explore our advanced guide to evaluating tech stocks for further insights.