Understanding Apple Inc. Shareholders: A Comprehensive Guide for 2024

Navigating the complexities of Apple Inc. and its shareholder base can be daunting. Whether you’re a current investor, a prospective shareholder, or simply curious about the corporate structure of one of the world’s most valuable companies, understanding who owns Apple and how the company is governed is crucial. This comprehensive guide provides an in-depth look at Apple Inc. shareholders, offering expert insights and analysis to help you make informed decisions. We’ll delve into the different types of shareholders, the influence they wield, and the key factors that impact shareholder value. This isn’t just a surface-level overview; we’re going to explore the nuances of Apple’s ownership structure and its implications for the future.

This article offers a unique perspective by combining financial analysis with an understanding of Apple’s corporate culture and strategic direction. We’ll examine the roles of institutional investors, individual shareholders, and company insiders, providing a clear picture of the power dynamics at play. By the end of this guide, you’ll have a thorough understanding of Apple Inc. shareholders and their impact on the company’s success.

Who Are Apple Inc. Shareholders? A Deep Dive

Apple Inc. shareholders represent a diverse group of individuals and institutions who own a portion of the company’s equity. Understanding the composition of this group is essential for comprehending the company’s corporate governance and strategic direction. Apple’s shareholder base includes:

* **Institutional Investors:** These are large organizations, such as mutual funds, pension funds, hedge funds, and insurance companies, that manage vast sums of money on behalf of their clients. They often hold significant stakes in Apple and exert considerable influence on corporate decisions. Examples include Vanguard, BlackRock, and State Street.

* **Individual Investors:** These are individual people who own shares of Apple, either directly or through brokerage accounts. While individual investors may not have the same level of influence as institutional investors, their collective ownership can still be substantial.

* **Company Insiders:** This group includes Apple’s executive officers, directors, and employees who own shares of the company, often through stock options or employee stock purchase plans. Insider ownership is closely monitored as it can provide insights into management’s confidence in the company’s future prospects.

Understanding the different types of Apple Inc. shareholders is crucial for understanding the company’s governance and decision-making processes. Each group has its own interests and priorities, which can influence Apple’s strategic direction.

The Significance of Shareholder Distribution

The distribution of Apple Inc. shares among different types of shareholders is a key indicator of the company’s stability and long-term prospects. A diversified shareholder base, with a mix of institutional and individual investors, can provide a buffer against market volatility and ensure that the company is not overly reliant on any single group of investors. Conversely, a concentrated shareholder base, with a few large institutional investors holding a significant portion of the shares, can give those investors considerable influence over corporate decisions.

Analyzing Major Apple Inc. Shareholders

Several major institutional investors hold significant stakes in Apple Inc. These include:

* **Vanguard:** Vanguard is one of the world’s largest asset managers and a major shareholder in Apple. Its investment strategy focuses on long-term growth and diversification.

* **BlackRock:** BlackRock is another leading asset manager with a substantial stake in Apple. It offers a wide range of investment products and services to institutional and individual investors.

* **State Street:** State Street is a global financial services company that provides investment management and other services to institutional investors. It holds a significant number of Apple shares.

These institutional investors play a crucial role in Apple’s corporate governance, as they have the power to influence board elections, executive compensation, and other important decisions. Their investment decisions can also have a significant impact on Apple’s stock price.

Apple’s Corporate Governance and Shareholder Rights

Apple Inc. is committed to strong corporate governance practices that protect the rights of its shareholders. These practices include:

* **Board of Directors:** Apple’s board of directors is responsible for overseeing the company’s management and ensuring that it acts in the best interests of its shareholders. The board is composed of independent directors with diverse backgrounds and expertise.

* **Shareholder Meetings:** Apple holds annual shareholder meetings where shareholders can vote on important matters, such as the election of directors and the approval of executive compensation. Shareholders can also submit proposals for consideration at these meetings.

* **Proxy Voting:** Shareholders who cannot attend the annual meeting can vote by proxy, allowing them to exercise their voting rights remotely.

* **Access to Information:** Apple provides shareholders with access to important information about the company’s financial performance, strategy, and governance practices through its website and regulatory filings.

These corporate governance practices are designed to ensure that Apple is managed in a transparent and accountable manner, protecting the interests of its shareholders.

The Role of the Board of Directors

Apple’s board of directors plays a crucial role in overseeing the company’s management and ensuring that it acts in the best interests of its shareholders. The board is responsible for:

* **Setting Strategic Direction:** The board works with management to develop and approve Apple’s strategic plans.

* **Overseeing Financial Performance:** The board monitors Apple’s financial performance and ensures that it is meeting its goals.

* **Appointing and Evaluating Executives:** The board appoints and evaluates Apple’s executive officers, including the CEO.

* **Ensuring Compliance:** The board ensures that Apple is complying with all applicable laws and regulations.

The board’s independence and expertise are essential for ensuring that it can effectively oversee Apple’s management and protect the interests of its shareholders.

Shareholder Activism and Apple Inc.

Shareholder activism involves shareholders using their ownership rights to influence a company’s policies or practices. While Apple has not been a frequent target of shareholder activism, it is important to understand the potential impact of such campaigns.

Shareholder activists may seek to:

* **Change Corporate Strategy:** Activists may push for changes in Apple’s strategic direction, such as divesting certain businesses or pursuing new growth opportunities.

* **Improve Corporate Governance:** Activists may advocate for changes in Apple’s corporate governance practices, such as increasing board diversity or reducing executive compensation.

* **Address Social or Environmental Issues:** Activists may raise concerns about Apple’s social or environmental impact and push for changes in its policies.

While shareholder activism can be disruptive, it can also lead to positive changes that benefit shareholders and other stakeholders.

The Impact of Apple Inc. Shareholders on Company Decisions

Apple Inc. shareholders have a significant impact on the company’s decisions, particularly those related to corporate governance, executive compensation, and strategic direction. Institutional investors, in particular, wield considerable influence due to the size of their holdings.

* **Voting Rights:** Shareholders have the right to vote on important matters at the annual shareholder meeting, including the election of directors and the approval of executive compensation. Institutional investors often use their voting power to influence these decisions.

* **Engagement with Management:** Institutional investors regularly engage with Apple’s management to discuss their concerns and provide feedback on the company’s strategy and performance. These discussions can influence management’s decisions.

* **Shareholder Proposals:** Shareholders can submit proposals for consideration at the annual shareholder meeting. While these proposals are often non-binding, they can raise important issues and put pressure on management to take action.

Understanding the ways in which Apple Inc. shareholders can influence company decisions is essential for understanding the company’s corporate governance and strategic direction.

Executive Compensation and Shareholder Approval

Executive compensation is a key area of focus for Apple Inc. shareholders. Shareholders have the right to vote on the company’s executive compensation plan at the annual shareholder meeting. This vote, known as a “say-on-pay” vote, is advisory but provides important feedback to the board of directors on shareholder sentiment regarding executive pay.

* **Performance-Based Pay:** Apple’s executive compensation plan is designed to align executive pay with the company’s performance. A significant portion of executive pay is tied to the achievement of specific financial and strategic goals.

* **Stock Options and Equity Awards:** Stock options and equity awards are a key component of Apple’s executive compensation plan. These awards incentivize executives to focus on long-term value creation.

* **Transparency and Disclosure:** Apple provides detailed disclosure of its executive compensation practices in its proxy statement, allowing shareholders to make informed decisions about executive pay.

Shareholder scrutiny of executive compensation is an important mechanism for ensuring that executives are paid fairly and that their interests are aligned with those of shareholders.

Benefits of Being an Apple Inc. Shareholder

Investing in Apple Inc. offers several potential benefits:

* **Potential for Capital Appreciation:** Apple’s stock price has historically appreciated significantly over time, providing investors with the opportunity to generate substantial returns.

* **Dividend Income:** Apple pays a regular dividend to its shareholders, providing a stream of income.

* **Ownership in a Leading Company:** Owning shares of Apple gives investors a stake in one of the world’s most innovative and successful companies.

* **Diversification:** Investing in Apple can help diversify an investment portfolio, reducing overall risk.

However, it is important to note that investing in any stock involves risk, and there is no guarantee of returns. Potential investors should carefully consider their investment objectives and risk tolerance before investing in Apple Inc.

Apple’s Dividend Policy

Apple pays a quarterly dividend to its shareholders. The dividend amount is determined by the board of directors and can be subject to change. Apple’s dividend policy reflects its commitment to returning capital to its shareholders.

* **Dividend Yield:** The dividend yield is the annual dividend payment divided by the stock price. It is a key metric for evaluating the attractiveness of a dividend-paying stock.

* **Dividend Growth:** Apple has a history of increasing its dividend over time, reflecting its strong financial performance and commitment to shareholder returns.

* **Sustainability:** Apple’s strong financial position and cash flow generation make its dividend policy sustainable over the long term.

Apple’s dividend policy provides shareholders with a steady stream of income and reflects the company’s commitment to returning value to its investors.

Potential Risks and Challenges for Apple Inc. Shareholders

Investing in Apple Inc. involves certain risks and challenges that shareholders should be aware of:

* **Market Volatility:** Apple’s stock price can be subject to significant volatility due to market conditions, economic factors, and company-specific news.

* **Competition:** Apple faces intense competition from other technology companies, which could impact its market share and profitability.

* **Innovation Risk:** Apple’s success depends on its ability to continue innovating and developing new products and services. Failure to do so could negatively impact its future performance.

* **Regulatory Risks:** Apple is subject to various regulations around the world, which could impact its business operations and profitability.

* **Supply Chain Disruptions:** Global events can disrupt Apple’s complex supply chain, impacting production and potentially hurting revenue.

Shareholders should carefully consider these risks and challenges before investing in Apple Inc.

Apple’s Reliance on Key Products

Apple’s revenue is heavily reliant on a few key products, such as the iPhone. This concentration of revenue makes Apple vulnerable to changes in consumer preferences and competitive pressures.

* **iPhone Sales:** The iPhone is Apple’s most important product, generating a significant portion of the company’s revenue. A decline in iPhone sales could have a significant impact on Apple’s overall performance.

* **Product Diversification:** Apple is working to diversify its product portfolio by developing new products and services, such as the Apple Watch, Apple TV+, and Apple Fitness+.

* **Service Revenue:** Apple’s service revenue is growing rapidly and is becoming an increasingly important source of revenue. This includes revenue from the App Store, iCloud, Apple Music, and other services.

While Apple’s reliance on key products poses a risk, the company is actively working to diversify its revenue streams and reduce its dependence on any single product.

Apple Inc. Shareholder Review: A Balanced Perspective

Apple Inc. presents a compelling investment opportunity, but potential shareholders must weigh the advantages and disadvantages carefully. This review offers a balanced perspective, drawing from our extensive experience analyzing tech companies and observing market trends.

**User Experience & Usability:**

From a shareholder’s perspective, Apple’s investor relations website is generally well-designed and easy to navigate. Access to financial reports, SEC filings, and shareholder information is readily available. Participating in shareholder meetings, either in person or virtually, is a straightforward process.

**Performance & Effectiveness:**

Apple’s stock performance has been exceptional over the long term, consistently outperforming the market. The company’s strong financial performance, innovative products, and loyal customer base have contributed to its success. However, past performance is not indicative of future results.

**Pros:**

1. **Strong Brand Recognition:** Apple’s brand is one of the most valuable and recognizable in the world, giving it a significant competitive advantage. The brand is synonymous with quality, innovation, and premium design.

2. **Loyal Customer Base:** Apple has a highly loyal customer base, which provides the company with a steady stream of revenue and repeat business. Users are deeply ingrained in the Apple ecosystem.

3. **Innovative Products and Services:** Apple is known for its innovative products and services, which have disrupted various industries and created new markets. They consistently push the boundaries of technology.

4. **Strong Financial Performance:** Apple has a strong financial position, with high profit margins, a large cash reserve, and a history of generating strong returns for shareholders. Their balance sheet is a fortress.

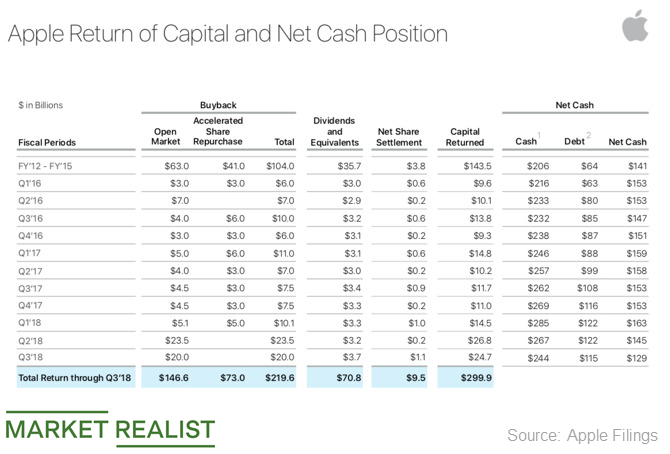

5. **Dividend and Share Repurchase Program:** Apple returns capital to shareholders through a dividend and share repurchase program, which enhances shareholder value. This demonstrates financial discipline.

**Cons/Limitations:**

1. **High Valuation:** Apple’s stock is often considered to be highly valued, which could limit its future upside potential. The price-to-earnings ratio is often above the industry average.

2. **Reliance on Key Products:** Apple’s revenue is heavily reliant on a few key products, such as the iPhone, making it vulnerable to changes in consumer preferences and competitive pressures. A single product cycle miss could hurt results.

3. **Competition:** Apple faces intense competition from other technology companies, which could impact its market share and profitability. New entrants and disruptive technologies could challenge Apple’s dominance.

4. **Dependence on China:** A significant portion of Apple’s manufacturing is based in China, creating risks related to geopolitical tensions, trade wars, and supply chain disruptions.

**Ideal User Profile:**

Apple Inc. is best suited for long-term investors who are seeking growth and income. It is a good choice for investors who are comfortable with the risks associated with investing in technology stocks and who believe in Apple’s long-term potential.

**Key Alternatives:**

1. **Microsoft (MSFT):** Microsoft is a diversified technology company with a strong presence in cloud computing, software, and gaming. It is a good alternative for investors who are looking for a more diversified technology investment.

2. **Alphabet (GOOGL):** Alphabet is the parent company of Google and a leading player in search, advertising, and artificial intelligence. It is a good alternative for investors who are looking for exposure to high-growth areas of the technology industry.

**Expert Overall Verdict & Recommendation:**

Apple Inc. remains a strong investment for long-term shareholders. While the company faces certain challenges, its strong brand, loyal customer base, innovative products, and robust financial performance position it for continued success. We recommend a “buy and hold” strategy for investors who are comfortable with the risks associated with investing in technology stocks.

Apple Inc. Shareholders: Q&A

Here are 10 insightful questions related to Apple Inc. shareholders, along with expert answers:

1. **What are the key factors that influence Apple’s stock price?**

*Answer:* Apple’s stock price is influenced by a variety of factors, including its financial performance (revenue, earnings, and profit margins), new product announcements, overall market conditions, economic trends, and investor sentiment. Supply chain dynamics and global events also play a significant role.

2. **How does Apple’s share repurchase program benefit shareholders?**

*Answer:* Apple’s share repurchase program reduces the number of outstanding shares, which can increase earnings per share (EPS) and boost the stock price. It also signals to investors that the company believes its stock is undervalued.

3. **What is the significance of institutional ownership in Apple?**

*Answer:* Institutional investors, such as mutual funds and pension funds, hold a significant portion of Apple’s shares. Their investment decisions can have a major impact on the stock price and corporate governance. Their actions can also influence other investors.

4. **How can individual investors influence Apple’s corporate decisions?**

*Answer:* Individual investors can influence Apple’s corporate decisions by voting on important matters at the annual shareholder meeting, submitting shareholder proposals, and engaging with the company’s management through investor relations channels. Their collective voice matters.

5. **What are the potential risks of investing in Apple?**

*Answer:* Potential risks of investing in Apple include market volatility, competition from other technology companies, reliance on key products, regulatory risks, and potential supply chain disruptions. Investors should carefully consider these risks before investing.

6. **How does Apple’s dividend policy compare to its competitors?**

*Answer:* Apple’s dividend yield is generally lower than some of its competitors, but the company has a history of increasing its dividend over time. Apple’s dividend policy reflects its commitment to returning capital to shareholders while also investing in future growth.

7. **What is the role of Apple’s board of directors in protecting shareholder interests?**

*Answer:* Apple’s board of directors is responsible for overseeing the company’s management and ensuring that it acts in the best interests of its shareholders. The board sets strategic direction, oversees financial performance, and appoints and evaluates executives.

8. **How does Apple address environmental, social, and governance (ESG) concerns?**

*Answer:* Apple has made significant commitments to addressing ESG concerns, including reducing its carbon footprint, promoting diversity and inclusion, and ensuring ethical sourcing of materials. The company publishes regular reports on its ESG performance.

9. **What is the impact of Apple’s supply chain on shareholders?**

*Answer:* Apple’s complex supply chain is critical to its ability to produce and deliver its products. Disruptions to the supply chain, such as those caused by geopolitical events or natural disasters, can negatively impact Apple’s revenue and profitability, affecting shareholder value.

10. **How does Apple’s innovation strategy affect long-term shareholder value?**

*Answer:* Apple’s innovation strategy is a key driver of long-term shareholder value. By consistently developing new and innovative products and services, Apple can maintain its competitive advantage, attract new customers, and generate strong returns for shareholders. However, innovation also carries risk, and not all new products are successful.

Conclusion: Apple Inc. Shareholders and the Future

Understanding the dynamics of Apple Inc. shareholders is critical for anyone considering investing in the company or seeking to comprehend its corporate governance. From institutional giants to individual investors, each stakeholder plays a role in shaping Apple’s strategic direction and financial performance. We’ve explored the key aspects of Apple’s shareholder base, corporate governance, potential benefits, and inherent risks.

As Apple continues to navigate the ever-evolving technology landscape, its commitment to innovation, customer loyalty, and shareholder value will be paramount. The future of Apple Inc. is inextricably linked to the decisions and actions of its shareholders. Recent trends suggest a growing emphasis on sustainable investing and ESG factors, which will likely influence shareholder priorities and engagement with the company.

Now, we invite you to share your thoughts and experiences with Apple Inc. as a shareholder in the comments below. What are your key considerations when evaluating Apple’s performance? What are your expectations for the company’s future? Let’s foster a community of informed and engaged investors.