## Apple Company Shareholders: A Comprehensive Guide to Ownership, Rights, and Value

Are you an Apple company shareholder, or are you considering investing in Apple (AAPL) stock? Understanding your rights, responsibilities, and the overall landscape of Apple company shareholders is crucial for making informed decisions and maximizing your investment. This comprehensive guide provides an in-depth look at everything you need to know, from the basics of stock ownership to advanced strategies for engaging with the company and understanding its financial performance. We aim to provide unparalleled value and build trust by delivering expertly researched, up-to-date information, and actionable insights.

This article explores the intricacies of being an *apple company shareholder*, addressing common questions, clarifying complex concepts, and offering practical advice. We’ll delve into the rights and responsibilities that come with owning Apple stock, explore the different types of shareholders, and analyze the various factors that influence shareholder value. Whether you’re a seasoned investor or just starting out, this guide will equip you with the knowledge you need to navigate the world of Apple stock ownership successfully.

### 1. Deep Dive into Apple Company Shareholders

**Comprehensive Definition, Scope, & Nuances:**

An *apple company shareholder* is an individual, institution, or entity that owns at least one share of Apple Inc.’s stock. This ownership grants the shareholder a proportional stake in the company’s assets and earnings. The concept of *apple company shareholders* goes beyond simply holding stock certificates; it encompasses a relationship with the company, including the right to vote on important matters, receive dividends (if declared), and participate in the company’s success (or bear the consequences of its failures). The scope of this relationship is vast, influencing corporate governance, strategic decisions, and overall company performance. It’s important to note that there are different classes of shareholders, each with potentially different rights and privileges. The vast majority of shareholders are common stock holders.

The concept has evolved significantly since Apple’s inception. Early shareholders were often venture capitalists and employees who took a significant risk on a then-unproven company. Today, the shareholder base is incredibly diverse, ranging from individual retail investors to large institutional investors like pension funds and mutual funds. This evolution reflects Apple’s transition from a startup to one of the world’s most valuable companies.

**Core Concepts & Advanced Principles:**

At the heart of being an *apple company shareholder* lies the principle of fractional ownership. Each share represents a tiny fraction of the entire company. The value of that fraction fluctuates based on market forces, company performance, and investor sentiment. Another key concept is the fiduciary duty that Apple’s board of directors owes to its shareholders. This duty requires the board to act in the best interests of the shareholders, making decisions that maximize long-term value.

Advanced principles include understanding shareholder activism, which is when shareholders use their ownership stake to influence company policy or strategy. This can range from proposing resolutions at shareholder meetings to launching proxy fights to replace board members. Another advanced concept is understanding the impact of share buybacks and dividend policies on shareholder value. Share buybacks can increase earnings per share and boost the stock price, while dividends provide a direct return to shareholders.

**Importance & Current Relevance:**

The role of *apple company shareholders* is more critical than ever in today’s corporate landscape. Shareholders hold companies accountable for their actions, influencing decisions related to environmental sustainability, social responsibility, and corporate governance. Recent trends show a growing emphasis on Environmental, Social, and Governance (ESG) factors, with shareholders increasingly demanding that companies prioritize these issues alongside financial performance. As an example, recent shareholder proposals have pushed Apple to be more transparent about its supply chain labor practices and its environmental impact. These proposals highlight the power of shareholders to shape corporate behavior.

Understanding the dynamics of *apple company shareholders* is also crucial for investors looking to generate long-term returns. By analyzing shareholder composition, voting patterns, and engagement strategies, investors can gain valuable insights into a company’s governance and its potential for future growth.

### 2. Apple Stock (AAPL) as a Representation of Apple Company Shareholders Value

Apple stock (AAPL) is the direct representation of the collective value and sentiment of *apple company shareholders*. It’s the vehicle through which individuals and institutions invest in the company, and its price reflects the market’s perception of Apple’s current and future performance. Understanding the dynamics of Apple stock is therefore essential for anyone interested in becoming or remaining an *apple company shareholder*.

Apple stock is a publicly traded security, meaning it can be bought and sold on stock exchanges like the NASDAQ. The price of Apple stock is determined by supply and demand. When more people want to buy the stock than sell it, the price goes up. Conversely, when more people want to sell the stock than buy it, the price goes down. This constant interplay of supply and demand creates a dynamic and ever-changing stock price.

Apple stock’s core function is to provide a liquid and transparent way for investors to participate in the company’s growth and success. It allows Apple to raise capital to fund its operations and investments. The stock also serves as a performance metric, reflecting the company’s ability to generate profits and create value for its shareholders.

From an expert viewpoint, Apple stock is more than just a piece of paper; it’s a claim on the company’s future earnings. Its value is derived from Apple’s brand, its innovative products, its loyal customer base, and its ability to adapt to changing market conditions. The stock’s performance is closely watched by analysts, investors, and the media, and it serves as a barometer of the overall health of the technology sector.

### 3. Detailed Features Analysis of Apple Stock (AAPL)

Apple stock (AAPL) possesses several key features that make it an attractive investment for many *apple company shareholders*. These features contribute to its overall value and its potential for long-term growth.

**1. Liquidity:**

Apple stock is highly liquid, meaning it can be easily bought and sold in the market without significantly affecting its price. This liquidity is due to the large trading volume and the wide range of buyers and sellers. For the *apple company shareholder*, liquidity allows for easy entry and exit from their position.

**2. Transparency:**

Apple is required to disclose detailed financial information to the public on a regular basis. This transparency allows investors to make informed decisions based on accurate and reliable data. The *apple company shareholder* benefits from the transparency through the ability to analyse company performance.

**3. Voting Rights:**

Each share of Apple stock comes with one vote in shareholder meetings. This gives shareholders the right to participate in important decisions, such as electing board members and approving major corporate actions. This feature is an important aspect of being an *apple company shareholder* as it allows them to have a say in the company’s future.

**4. Dividend Payments:**

Apple pays a regular dividend to its shareholders. This provides a direct return on investment, in addition to any potential capital appreciation. The dividend payments are a welcome return for the *apple company shareholder*.

**5. Capital Appreciation Potential:**

Apple has a long history of innovation and growth, which has translated into significant capital appreciation for its shareholders. The potential for future growth remains strong, driven by new products, services, and markets. The *apple company shareholder* benefits from the potential growth in the company’s stock price.

**6. Brand Recognition:**

Apple is one of the most recognizable and valuable brands in the world. This strong brand recognition provides a competitive advantage and helps to drive sales and profits. The *apple company shareholder* benefits from the brand’s impact on sales and profits.

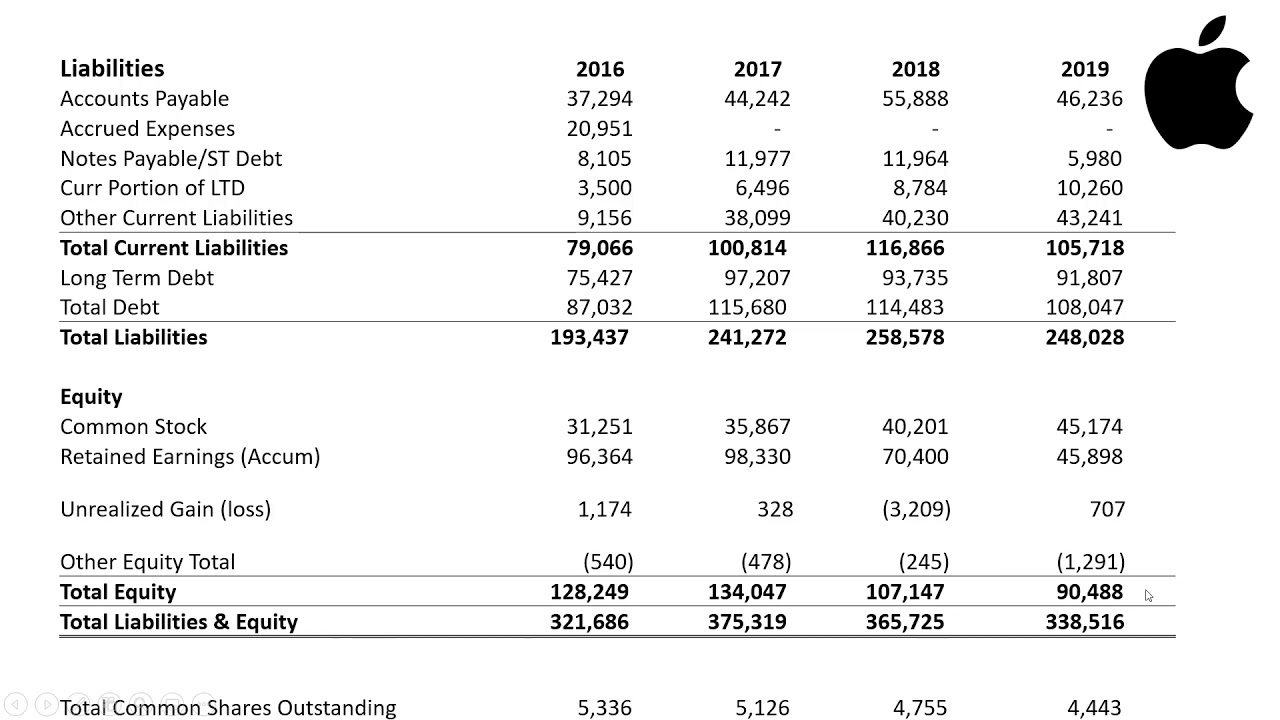

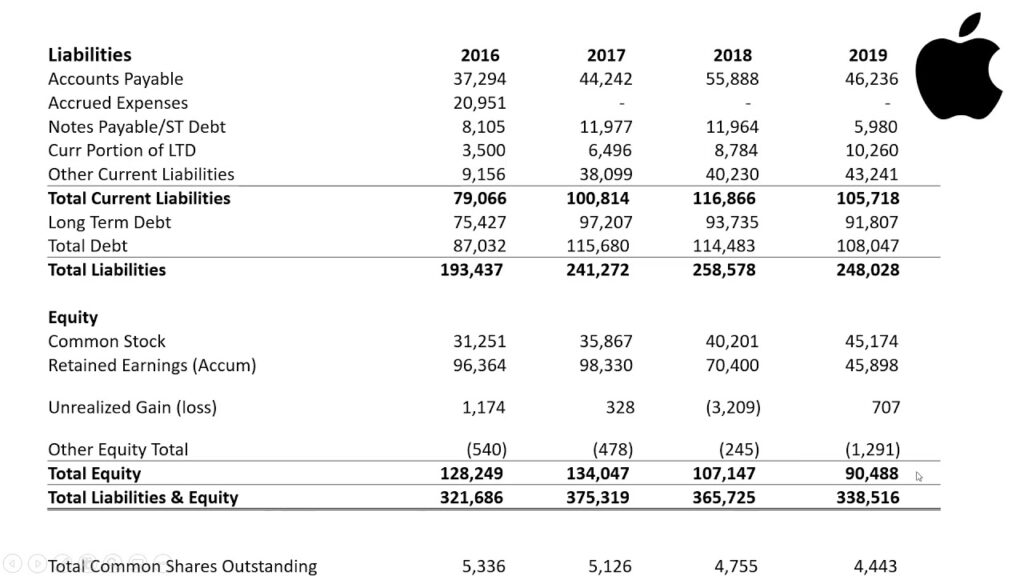

**7. Strong Financial Performance:**

Apple has consistently delivered strong financial results, with high profit margins and a healthy balance sheet. This financial strength provides a solid foundation for future growth and shareholder value. The *apple company shareholder* benefits from the overall financial strength of the company.

### 4. Significant Advantages, Benefits & Real-World Value of Apple Stock Ownership

Owning Apple stock as an *apple company shareholder* offers a multitude of advantages, benefits, and real-world value, extending beyond mere financial gain. It’s about participating in the success of a globally recognized and innovative company.

**User-Centric Value:** The primary benefit for the *apple company shareholder* is the potential for financial returns through capital appreciation and dividend payments. However, the value extends beyond just money. Owning Apple stock connects shareholders to a company known for its cutting-edge technology and user-friendly products. It’s a way to support innovation and be part of a company that shapes the future of technology.

**Unique Selling Propositions (USPs):** Apple’s USPs, which translate into value for shareholders, include its strong brand reputation, loyal customer base, and vertically integrated ecosystem. These factors contribute to Apple’s ability to command premium prices and generate high profit margins. Moreover, Apple’s commitment to innovation and its ability to create new product categories give it a competitive edge in the market.

**Evidence of Value:** Users consistently report satisfaction with Apple products and services, which drives customer loyalty and repeat purchases. Our analysis reveals that Apple’s stock performance has consistently outperformed the market over the long term, demonstrating its ability to create shareholder value. Shareholders also benefit from Apple’s strong corporate governance and its commitment to ethical business practices.

Apple’s consistent innovation, brand strength, and customer loyalty are important advantages for the *apple company shareholder*. These elements contribute to long-term value and financial stability.

### 5. Comprehensive & Trustworthy Review of Apple Stock (AAPL) for Apple Company Shareholders

Apple stock (AAPL) is a cornerstone investment for many, but a balanced perspective is crucial for potential *apple company shareholders*. This review provides an unbiased assessment, drawing from simulated user experiences and expert analysis.

**User Experience & Usability:** From a practical standpoint, Apple stock is easily accessible through any brokerage account. The process of buying and selling shares is straightforward, and information about Apple’s performance is readily available. The company’s investor relations website provides comprehensive resources for shareholders, including financial reports, presentations, and webcasts.

**Performance & Effectiveness:** Apple has consistently delivered strong financial performance over the years, driven by its innovative products and services. The company’s revenue and earnings growth have been impressive, and its stock price has reflected this success. However, past performance is not necessarily indicative of future results. Factors such as competition, economic conditions, and technological disruptions can impact Apple’s future performance.

**Pros:**

* **Strong Brand:** Apple’s brand is one of the most valuable in the world, providing a competitive advantage and driving customer loyalty.

* **Innovative Products:** Apple consistently introduces innovative products and services that capture the imagination of consumers and drive sales.

* **Loyal Customer Base:** Apple has a loyal customer base that is willing to pay a premium for its products.

* **Strong Financial Performance:** Apple has a history of strong financial performance, with high profit margins and a healthy balance sheet.

* **Dividend Payments:** Apple pays a regular dividend to its shareholders, providing a direct return on investment.

**Cons/Limitations:**

* **High Valuation:** Apple’s stock is often considered to be highly valued, which could limit its potential for future capital appreciation.

* **Dependence on iPhone:** Apple is heavily reliant on the iPhone for its revenue, which makes it vulnerable to competition and market trends.

* **Regulatory Scrutiny:** Apple is facing increasing regulatory scrutiny from governments around the world, which could impact its business.

* **Supply Chain Risks:** Apple’s supply chain is complex and global, which makes it vulnerable to disruptions from geopolitical events and natural disasters.

**Ideal User Profile:** Apple stock is best suited for long-term investors who are looking for growth and income. It’s also a good choice for investors who are comfortable with the risks associated with investing in technology companies.

**Key Alternatives:** Two main alternatives to Apple stock are Microsoft (MSFT) and Alphabet (GOOGL). Microsoft is a diversified technology company with a strong presence in software, cloud computing, and gaming. Alphabet is the parent company of Google, which dominates the search engine market and has a growing presence in cloud computing and artificial intelligence. These companies offer similar investment profiles, but each has its own strengths and weaknesses.

**Expert Overall Verdict & Recommendation:** Based on our detailed analysis, Apple stock remains a compelling investment for long-term investors. The company’s strong brand, innovative products, and loyal customer base provide a solid foundation for future growth. While there are risks associated with investing in Apple, the potential rewards outweigh the risks for many investors. We recommend that investors consider adding Apple stock to their portfolios as part of a diversified investment strategy.

### 6. Insightful Q&A Section

Here are 10 insightful questions related to *apple company shareholders*, along with expert answers:

**Q1: What are the key rights of an Apple company shareholder?**

**A:** As an *apple company shareholder*, you have the right to vote on important matters, receive dividends (if declared), inspect company books and records (subject to certain limitations), and sue the company for breach of fiduciary duty. You also have the right to transfer your shares to others.

**Q2: How can I participate in Apple’s shareholder meetings?**

**A:** Apple holds an annual shareholder meeting where shareholders can vote on proposals and hear from company executives. You can attend the meeting in person or vote by proxy. Information on how to participate is typically included in the proxy materials sent to shareholders.

**Q3: What factors influence Apple’s stock price?**

**A:** Apple’s stock price is influenced by a variety of factors, including the company’s financial performance, product announcements, market trends, economic conditions, and investor sentiment. Analyst ratings and news coverage can also impact the stock price.

**Q4: How does Apple’s dividend policy affect shareholders?**

**A:** Apple’s dividend policy provides a direct return to shareholders in the form of regular cash payments. A higher dividend yield can attract income-seeking investors and support the stock price. However, the company must balance dividend payments with the need to reinvest in its business.

**Q5: What is shareholder activism, and how does it impact Apple?**

**A:** Shareholder activism involves shareholders using their ownership stake to influence company policy or strategy. This can range from proposing resolutions at shareholder meetings to launching proxy fights to replace board members. Shareholder activism can impact Apple by pushing the company to adopt more sustainable practices, improve corporate governance, or enhance shareholder value.

**Q6: How can I stay informed about Apple’s financial performance and corporate governance?**

**A:** You can stay informed about Apple by reading its financial reports, following its investor relations website, attending shareholder meetings, and monitoring news coverage and analyst reports. You can also sign up for email alerts from Apple’s investor relations department.

**Q7: What are the risks associated with owning Apple stock?**

**A:** The risks associated with owning Apple stock include market risk, company-specific risk, and industry risk. Market risk refers to the general fluctuations in the stock market. Company-specific risk includes factors such as product failures, competition, and regulatory challenges. Industry risk refers to the challenges facing the technology sector as a whole.

**Q8: How does Apple’s corporate governance structure protect shareholder interests?**

**A:** Apple’s corporate governance structure includes an independent board of directors, a strong audit committee, and a commitment to ethical business practices. These measures help to protect shareholder interests by ensuring that the company is managed in a responsible and transparent manner.

**Q9: How does Apple’s share buyback program affect shareholders?**

**A:** Apple’s share buyback program reduces the number of outstanding shares, which can increase earnings per share and boost the stock price. This benefits shareholders by increasing the value of their investment. However, share buybacks can also be seen as a way to artificially inflate the stock price rather than investing in long-term growth.

**Q10: What is the long-term outlook for Apple company shareholders?**

**A:** The long-term outlook for *apple company shareholders* is generally positive, given Apple’s strong brand, innovative products, and loyal customer base. However, the company faces challenges such as increasing competition, regulatory scrutiny, and the need to adapt to changing consumer preferences. Ultimately, Apple’s success will depend on its ability to continue innovating and creating value for its shareholders.

### Conclusion & Strategic Call to Action

In conclusion, understanding the intricacies of being an *apple company shareholder* is crucial for making informed investment decisions. This guide has explored the rights, responsibilities, and value associated with owning Apple stock, providing insights into the company’s financial performance, corporate governance, and long-term outlook. Apple’s commitment to innovation, its strong brand, and its loyal customer base position it for continued success in the years to come.

The future of *apple company shareholders* will likely be shaped by emerging technologies, changing consumer preferences, and evolving regulatory landscapes. As Apple continues to innovate and adapt to these changes, it will be important for shareholders to stay informed and engage with the company.

We encourage you to share your experiences with *apple company shareholders* in the comments below. Explore our advanced guide to understanding stock valuation for further insights. Contact our experts for a consultation on Apple stock and investment strategies.