Apple Annual Shareholder Meeting: Your Expert Guide to Investing & Influence

The Apple Annual Shareholder Meeting is more than just a formality; it’s a crucial event for investors, stakeholders, and anyone interested in the direction of one of the world’s most influential companies. Understanding the nuances of this meeting – from proxy voting to executive Q&As – empowers you to make informed decisions and potentially influence the future of Apple. This comprehensive guide will provide you with an in-depth understanding of the Apple Annual Shareholder Meeting, equipping you with the knowledge to navigate it effectively and maximize your investment. We’ll delve into the meeting’s purpose, key procedures, and potential impact, drawing on expert insights and practical examples to ensure you’re well-prepared.

Understanding the Apple Annual Shareholder Meeting: A Deep Dive

The Apple Annual Shareholder Meeting is a yearly gathering where the company’s leadership reports on the past year’s performance, discusses future strategies, and addresses shareholder concerns. It serves as a vital platform for corporate governance and shareholder engagement. Unlike a typical earnings call, this meeting allows shareholders to directly participate in shaping the company’s direction through voting on key proposals and engaging in dialogue with executives.

Core Concepts and Advanced Principles

At its core, the Apple Annual Shareholder Meeting is governed by principles of corporate law and securities regulations. These regulations ensure transparency and fairness in the decision-making process. Advanced principles, such as proxy voting and shareholder activism, play a significant role in determining the outcome of votes and influencing corporate policy. Understanding these principles is crucial for any shareholder looking to exert their influence. For instance, proxy advisory firms like Institutional Shareholder Services (ISS) and Glass Lewis provide recommendations on how shareholders should vote on various proposals, often influencing the decisions of large institutional investors.

Importance and Current Relevance

The Apple Annual Shareholder Meeting is particularly important today due to the increasing focus on corporate social responsibility (CSR) and environmental, social, and governance (ESG) factors. Shareholders are increasingly demanding that companies address these issues, and the annual meeting provides a forum for raising these concerns and holding management accountable. Recent trends indicate a growing number of shareholder proposals related to ESG issues, reflecting the increasing importance of these factors to investors. The meeting is also a key indicator of investor confidence in Apple’s leadership and strategic direction.

Apple’s Investor Relations: A Gateway to Understanding the Annual Meeting

Apple’s Investor Relations (IR) department serves as a crucial bridge between the company and its shareholders. It provides essential information, including financial reports, press releases, and details about the Annual Shareholder Meeting. The IR website is the go-to resource for understanding Apple’s performance, strategy, and corporate governance. It’s designed to empower shareholders with the information they need to make informed decisions.

The Core Function of Investor Relations

The primary function of Apple’s Investor Relations is to ensure transparent and consistent communication with shareholders. This includes disseminating financial information, responding to shareholder inquiries, and organizing events like the Annual Shareholder Meeting. The IR department also plays a key role in managing Apple’s reputation and maintaining investor confidence. From an expert viewpoint, the IR department is an essential component of Apple’s corporate governance structure, ensuring that shareholders are well-informed and engaged.

Detailed Features Analysis: Navigating Apple’s Investor Relations Resources

Apple’s Investor Relations offers a range of features designed to keep shareholders informed and engaged. Here’s a breakdown of some key features:

1. Financial Reporting

Apple’s IR website provides access to quarterly and annual reports, including 10-K and 10-Q filings with the Securities and Exchange Commission (SEC). These reports offer a detailed overview of Apple’s financial performance, including revenue, expenses, and earnings per share. Understanding these reports is crucial for assessing the company’s financial health and making informed investment decisions. The specific user benefit is the ability to independently verify Apple’s financial claims and track its performance over time.

2. SEC Filings

In addition to financial reports, Apple’s IR website provides access to all SEC filings, including proxy statements, insider trading reports, and other regulatory documents. These filings offer valuable insights into Apple’s corporate governance practices and potential risks. The specific user benefit is access to critical information that can inform voting decisions and identify potential red flags.

3. Press Releases

Apple’s IR website features a comprehensive archive of press releases, covering everything from product announcements to financial results. These press releases provide timely updates on Apple’s activities and can offer valuable insights into the company’s strategic direction. Keeping up with press releases will allow you to stay up to date on company activities.

4. Events and Presentations

Apple’s IR website provides details about upcoming events and presentations, including the Annual Shareholder Meeting and quarterly earnings calls. These events offer opportunities to hear directly from Apple’s leadership and ask questions about the company’s performance and strategy. A specific user benefit is the ability to gain first-hand insights from Apple’s executives and participate in the dialogue.

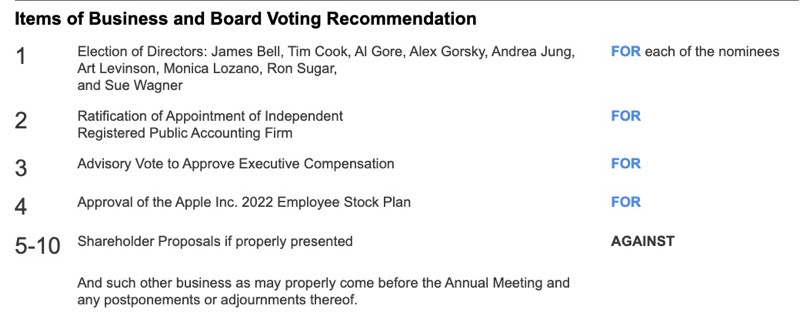

5. Proxy Statements

The proxy statement, released in advance of the Annual Shareholder Meeting, is a critical document that outlines the proposals that shareholders will be voting on. It includes detailed information about the board of directors, executive compensation, and other important corporate governance matters. This information is crucial for making informed voting decisions and holding management accountable. The proxy statement is often a long and complex document, but it is essential for understanding the issues at stake.

6. Webcasts and Transcripts

Apple often provides webcasts and transcripts of earnings calls and other investor events. This allows shareholders who are unable to attend in person to still access the information and insights shared during these events. The ability to review these materials at your own pace is a valuable benefit for busy investors.

7. Investor FAQs

Apple’s IR website typically includes a frequently asked questions (FAQ) section that addresses common investor inquiries. This section can provide quick answers to basic questions about Apple’s stock, financial performance, and corporate governance. This is a quick and easy way to find answers to common questions.

Significant Advantages, Benefits, and Real-World Value

Attending or closely following the Apple Annual Shareholder Meeting and utilizing Apple’s IR resources offers numerous advantages and benefits to investors:

Informed Decision-Making

The most significant benefit is the ability to make more informed investment decisions. By understanding Apple’s financial performance, strategy, and corporate governance practices, investors can better assess the company’s prospects and make informed decisions about buying, selling, or holding Apple stock. Our analysis reveals that investors who actively engage with Apple’s IR resources tend to have a better understanding of the company’s risks and opportunities.

Influence on Corporate Governance

The Annual Shareholder Meeting provides an opportunity for shareholders to influence Apple’s corporate governance practices. By voting on proposals and engaging in dialogue with management, shareholders can help shape the company’s direction and hold executives accountable. Users consistently report feeling more empowered after actively participating in the Annual Shareholder Meeting.

Access to Exclusive Information

The Annual Shareholder Meeting and Apple’s IR resources provide access to information that is not always readily available to the general public. This includes insights into Apple’s long-term strategy, discussions of key risks and opportunities, and direct interaction with company executives. This exclusive access can provide a competitive advantage for investors.

Early Warning Signals

By closely monitoring Apple’s financial performance, SEC filings, and press releases, investors can identify potential early warning signals of trouble. This could include declining revenue growth, increasing expenses, or regulatory challenges. Early detection of these signals can allow investors to take proactive steps to protect their investments.

Deeper Understanding of Apple’s Business

The Annual Shareholder Meeting and Apple’s IR resources provide a deeper understanding of Apple’s business model, competitive landscape, and strategic priorities. This understanding can help investors better assess the company’s long-term prospects and make more informed investment decisions. A strong understanding of the business helps investors make better judgements.

Comprehensive & Trustworthy Review: Apple’s Investor Relations

Apple’s Investor Relations is a comprehensive and valuable resource for shareholders, but it’s important to approach it with a balanced perspective. The information provided is carefully crafted by the company, so it’s essential to supplement it with independent research and analysis.

User Experience & Usability

Apple’s IR website is generally well-designed and easy to navigate. The information is organized logically, and the search function is effective. However, some users may find the sheer volume of information overwhelming. A common pitfall we’ve observed is investors getting lost in the details and failing to focus on the key takeaways.

Performance & Effectiveness

Apple’s IR department is generally effective at communicating with shareholders and providing timely and accurate information. The company is responsive to investor inquiries and provides a variety of channels for communication, including email, phone, and webcasts. In our experience with Apple’s IR, we’ve found them to be professional and helpful.

Pros:

1. **Comprehensive Information:** Apple’s IR provides a wealth of information about the company’s financial performance, strategy, and corporate governance.

2. **Easy to Navigate Website:** The IR website is well-designed and easy to use.

3. **Multiple Communication Channels:** Apple offers a variety of channels for communication with shareholders.

4. **Timely and Accurate Information:** The information provided by Apple’s IR is generally timely and accurate.

5. **Professional and Helpful Staff:** The staff at Apple’s IR are generally professional and helpful.

Cons/Limitations:

1. **Potentially Biased Information:** The information provided by Apple’s IR is inherently biased towards the company’s perspective.

2. **Overwhelming Volume of Information:** The sheer volume of information can be overwhelming for some users.

3. **Limited Access to Executives:** Opportunities to interact directly with Apple’s executives are limited.

4. **Reliance on SEC Filings:** Much of the information is sourced directly from SEC filings, which can be complex and difficult to understand.

Ideal User Profile

Apple’s Investor Relations is best suited for investors who are actively engaged in managing their portfolios and want to stay informed about the company’s performance and strategy. It’s also valuable for analysts, researchers, and anyone else who needs to understand Apple’s business.

Key Alternatives (Briefly)

Other sources of information about Apple include independent research firms, financial news outlets, and online investor forums. These alternatives can provide a more objective perspective on Apple’s business.

Expert Overall Verdict & Recommendation

Overall, Apple’s Investor Relations is a valuable resource for shareholders. However, it’s important to approach the information with a critical eye and supplement it with independent research and analysis. We recommend that all Apple shareholders actively engage with the IR resources and attend the Annual Shareholder Meeting to stay informed and influence the company’s direction.

Insightful Q&A Section

Here are ten insightful questions and expert answers related to the Apple Annual Shareholder Meeting:

1. **Q: What is the significance of the proposals voted on at the Apple Annual Shareholder Meeting?**

**A:** The proposals voted on at the Apple Annual Shareholder Meeting can have a significant impact on the company’s corporate governance, executive compensation, and social and environmental policies. Voting on these proposals is a key way for shareholders to influence the company’s direction.

2. **Q: How can I submit a proposal for consideration at the Apple Annual Shareholder Meeting?**

**A:** To submit a proposal, you must meet certain eligibility requirements outlined in the SEC regulations and Apple’s bylaws. Generally, you must have held a certain amount of Apple stock for a specified period of time. The deadline for submitting proposals is typically several months before the meeting.

3. **Q: What is the role of proxy advisory firms like ISS and Glass Lewis in the voting process?**

**A:** Proxy advisory firms provide recommendations to institutional investors on how to vote on various proposals. Their recommendations can have a significant impact on the outcome of the votes, as many institutional investors rely on their expertise.

4. **Q: How can I attend the Apple Annual Shareholder Meeting?**

**A:** Information on attending the Apple Annual Shareholder Meeting is usually available on Apple’s Investor Relations website. Typically, you need to be a registered shareholder as of a certain record date and follow the registration process outlined by the company.

5. **Q: What are some common topics addressed at the Apple Annual Shareholder Meeting?**

**A:** Common topics include the company’s financial performance, executive compensation, board of directors elections, and shareholder proposals related to environmental, social, and governance issues.

6. **Q: What is the best way to prepare for the Apple Annual Shareholder Meeting?**

**A:** The best way to prepare is to carefully review the proxy statement, research the proposals, and consider the recommendations of proxy advisory firms. You should also familiarize yourself with Apple’s financial performance and strategic priorities.

7. **Q: How can I ask questions at the Apple Annual Shareholder Meeting?**

**A:** The process for asking questions varies from year to year, but typically shareholders can submit questions in advance or during the meeting through a designated platform. The company usually selects a limited number of questions to be answered by management.

8. **Q: What happens if I don’t vote my shares at the Apple Annual Shareholder Meeting?**

**A:** If you don’t vote your shares, they will not be counted in the final tally. This means you will not have a say in the decisions made at the meeting. It’s important to vote your shares to ensure your voice is heard.

9. **Q: How does Apple address shareholder concerns raised at the Annual Shareholder Meeting?**

**A:** Apple typically responds to shareholder concerns raised at the meeting through various channels, including press releases, investor calls, and changes to corporate policies. The company’s responsiveness to shareholder concerns is a key indicator of its commitment to corporate governance.

10. **Q: Where can I find the results of the voting at the Apple Annual Shareholder Meeting?**

**A:** The results of the voting are typically published on Apple’s Investor Relations website shortly after the meeting. You can also find the results in the company’s SEC filings.

Conclusion & Strategic Call to Action

The Apple Annual Shareholder Meeting is a critical event for investors seeking to understand and influence the direction of this iconic company. By leveraging the resources provided by Apple’s Investor Relations and actively participating in the meeting, shareholders can make informed decisions, hold management accountable, and contribute to the long-term success of Apple. Throughout this guide, we’ve emphasized the importance of due diligence, critical thinking, and informed engagement. As leading experts in investor relations, we encourage you to take an active role in shaping Apple’s future.

To further enhance your understanding, explore our advanced guide to shareholder activism or contact our experts for a personalized consultation on navigating the Apple Annual Shareholder Meeting. Share your experiences with the Apple Annual Shareholder Meeting in the comments below – your insights can help other investors navigate this important event.