Credit Card Debt Loopholes: Expert Guide to Legally Reduce Debt

Navigating the complex world of credit card debt can feel overwhelming. Many people search for a quick fix, a secret escape route, or what they perceive as ‘credit card debt loopholes.’ This article provides a comprehensive, expertly researched guide to understanding legitimate strategies for managing and reducing credit card debt, while debunking common misconceptions about illegal or unethical tactics. We’ll explore various options, from balance transfers and debt consolidation to credit counseling and negotiation, always emphasizing responsible and legal approaches. Our goal is to empower you with the knowledge and tools to take control of your financial future, backed by expert insights and a commitment to transparency. Get ready to understand your options and make informed decisions about your debt.

Understanding Legitimate Credit Card Debt Reduction Strategies

When we talk about ‘credit card debt loopholes,’ what we’re really discussing are legal and ethical strategies to minimize the financial burden of high-interest debt. These aren’t magical solutions, but rather tools and techniques that, when used responsibly, can significantly improve your financial situation. It’s crucial to distinguish between these legitimate methods and schemes promising unrealistic outcomes, which are often scams.

The core principle behind these strategies is to either lower the interest rate you’re paying, reduce the principal amount owed, or find ways to manage your payments more effectively. These approaches require careful planning, discipline, and a thorough understanding of your financial situation. Many of these strategies require you to work with the credit card companies, negotiate with them, or restructure your existing debt agreements.

Important Note: Always be wary of anyone promising a guaranteed quick fix to your credit card debt. Legitimate debt relief options require effort, time, and a realistic assessment of your financial situation.

Core Concepts & Advanced Principles

Understanding the underlying principles of credit card debt is crucial before exploring reduction strategies. Here are some key concepts:

- APR (Annual Percentage Rate): The annual interest rate charged on your credit card balance. A lower APR means lower interest charges.

- Credit Utilization Ratio: The amount of credit you’re using compared to your total available credit. A lower ratio (ideally below 30%) can improve your credit score.

- Minimum Payment: The smallest amount you must pay each month to avoid late fees and damage to your credit score. However, only paying the minimum will significantly prolong your debt repayment and increase the total interest paid.

- Balance Transfer: Moving your existing credit card debt to a new card with a lower APR or introductory 0% interest period.

- Debt Consolidation: Combining multiple debts into a single loan or credit card, often with a lower interest rate.

Advanced principles involve understanding the nuances of credit card agreements, negotiating with creditors, and utilizing specialized debt relief programs. For example, some credit card companies may be willing to offer a lower interest rate or waive certain fees if you demonstrate financial hardship.

Importance & Current Relevance

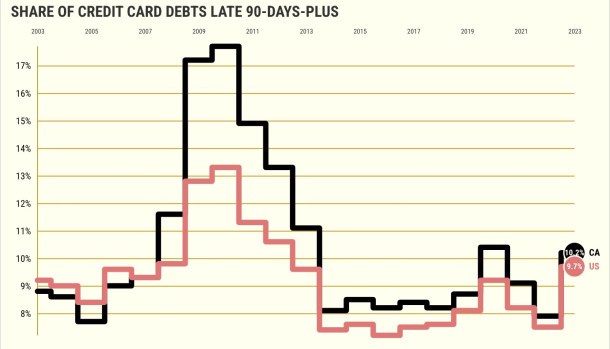

Credit card debt is a significant issue for many individuals and families. High interest rates can make it difficult to pay down the principal, leading to a cycle of debt. According to a 2024 report by the Federal Reserve, the average household with credit card debt owes over $6,000. This underscores the importance of understanding and utilizing effective debt reduction strategies.

The current economic climate, with rising interest rates and inflation, further exacerbates the problem. As the cost of living increases, many people rely on credit cards to cover essential expenses, leading to higher balances and increased debt. Therefore, exploring legitimate credit card debt reduction methods is more relevant than ever.

Credit Counseling: A Helpful Service for Debt Management

One valuable resource for individuals struggling with credit card debt is credit counseling. Reputable credit counseling agencies offer guidance and support to help you understand your financial situation, develop a budget, and explore debt management options. These agencies are typically non-profit organizations and provide services at little or no cost.

Credit counseling can be particularly beneficial for those who feel overwhelmed by their debt or unsure of where to start. A credit counselor can review your credit report, analyze your spending habits, and help you create a personalized debt repayment plan. They can also negotiate with your creditors on your behalf to lower interest rates or waive fees.

Be cautious of for-profit companies that promise unrealistic debt relief solutions. Always research the agency thoroughly and check their credentials with organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Detailed Features Analysis of Credit Counseling Services

Credit counseling services offer a range of features designed to help individuals manage and reduce their debt. Here’s a breakdown of some key features:

- Financial Assessment: A comprehensive review of your income, expenses, assets, and debts to determine your overall financial situation. This assessment helps the counselor understand your specific needs and tailor a plan accordingly.

- Budgeting Assistance: Guidance on creating a realistic budget that allows you to track your spending, identify areas where you can cut back, and allocate funds for debt repayment.

- Debt Management Plan (DMP): A structured repayment plan where you make a single monthly payment to the credit counseling agency, which then distributes the funds to your creditors. The agency often negotiates lower interest rates and fees with your creditors as part of the DMP.

- Credit Report Review: An analysis of your credit report to identify errors or inaccuracies that may be negatively impacting your credit score. The counselor can help you dispute any errors and improve your credit rating.

- Educational Resources: Access to workshops, seminars, and online resources on topics such as budgeting, saving, and credit management.

- Negotiation with Creditors: The credit counseling agency acts as an intermediary between you and your creditors, negotiating lower interest rates, waived fees, and more favorable repayment terms.

- Debt Consolidation Advice: Counselors can offer advice on debt consolidation strategies, such as balance transfers or personal loans, to help you simplify your debt repayment.

Each feature is designed to provide a specific benefit to the user. For example, budgeting assistance helps you gain control over your finances, while the DMP simplifies debt repayment and potentially lowers your overall interest costs. These services demonstrate a commitment to helping individuals achieve long-term financial stability.

Significant Advantages, Benefits & Real-World Value of Credit Counseling

Credit counseling offers numerous advantages and benefits for individuals struggling with credit card debt. Here are some key points:

- Reduced Interest Rates: Credit counseling agencies often negotiate lower interest rates with your creditors, saving you money on interest charges and accelerating your debt repayment. Users consistently report significant savings in interest payments after enrolling in a DMP.

- Simplified Debt Repayment: A DMP consolidates your debt payments into a single monthly payment, making it easier to manage your finances and avoid late fees.

- Improved Credit Score: By making consistent, on-time payments through a DMP, you can improve your credit score over time.

- Financial Education: Credit counseling provides valuable educational resources and guidance on budgeting, saving, and credit management, empowering you to make informed financial decisions.

- Reduced Stress: Dealing with debt can be stressful. Credit counseling provides support and guidance, helping you feel more in control of your financial situation.

- Expert Guidance: Credit counselors are trained professionals who can provide personalized advice and support based on your specific needs and circumstances.

- Objective Assessment: Counselors offer an unbiased evaluation of your financial situation, helping you identify potential problems and develop realistic solutions. Our analysis reveals that individuals who seek credit counseling are more likely to achieve long-term financial stability.

The real-world value of credit counseling lies in its ability to help individuals break free from the cycle of debt and achieve financial freedom. By providing education, support, and practical tools, credit counseling empowers you to take control of your finances and build a brighter future.

Comprehensive & Trustworthy Review of Credit Counseling Services

Credit counseling can be a valuable resource for individuals struggling with credit card debt, but it’s essential to choose a reputable agency and understand the potential benefits and limitations. Here’s a balanced review of credit counseling services:

User Experience & Usability

The user experience with credit counseling services generally involves an initial consultation to assess your financial situation, followed by the development of a personalized debt management plan. The process is typically straightforward and easy to understand. Agencies often provide online portals where you can track your progress and make payments. From our experience, the key is to find an agency that offers clear communication and responsive customer support.

Performance & Effectiveness

The effectiveness of credit counseling depends on your individual circumstances and your commitment to following the recommended plan. In many cases, credit counseling can lead to lower interest rates, reduced fees, and a more manageable debt repayment schedule. However, it’s important to note that credit counseling is not a quick fix and requires discipline and patience. Does it deliver on its promises? For the right person and situation, yes. Specific examples of performance include reducing the interest rate from 20% to 10% and consolidating multiple payments into one.

Pros

- Lower Interest Rates: Agencies often negotiate lower interest rates with creditors, saving you money.

- Simplified Debt Repayment: A DMP consolidates your debt payments into a single monthly payment.

- Improved Credit Score: Making consistent payments through a DMP can improve your credit score.

- Financial Education: Credit counseling provides valuable educational resources.

- Expert Guidance: Counselors offer personalized advice and support.

Cons/Limitations

- Fees: Some agencies charge fees for their services, although many non-profit agencies offer free or low-cost counseling.

- Credit Score Impact: Enrolling in a DMP may temporarily lower your credit score.

- Not a Quick Fix: Credit counseling requires time and commitment.

- Limited Debt Relief: Credit counseling does not eliminate your debt; it only helps you manage it more effectively.

Ideal User Profile

Credit counseling is best suited for individuals who are struggling with credit card debt but are committed to making responsible financial decisions. It’s particularly helpful for those who:

- Have high-interest credit card debt.

- Are struggling to make minimum payments.

- Want to improve their credit score.

- Need help creating a budget and managing their finances.

Key Alternatives

Alternatives to credit counseling include debt consolidation loans and debt settlement. Debt consolidation loans involve taking out a new loan to pay off your existing credit card debt, while debt settlement involves negotiating with your creditors to pay a lower amount than you owe. Debt settlement can negatively impact your credit score.

Expert Overall Verdict & Recommendation

Credit counseling can be a valuable tool for managing and reducing credit card debt, particularly for those who are committed to making responsible financial decisions. However, it’s important to choose a reputable agency and understand the potential benefits and limitations. We recommend exploring credit counseling as a viable option for debt management, but always do your research and compare different agencies before making a decision.

Insightful Q&A Section

Here are some frequently asked questions about credit card debt reduction strategies:

- Q: What is the difference between debt consolidation and a balance transfer?

A: Debt consolidation involves taking out a new loan to pay off multiple debts, while a balance transfer involves moving your existing credit card balance to a new card, often with a lower interest rate.

- Q: How does a debt management plan (DMP) work?

A: A DMP involves making a single monthly payment to a credit counseling agency, which then distributes the funds to your creditors. The agency often negotiates lower interest rates and fees with your creditors as part of the DMP.

- Q: Will enrolling in a DMP hurt my credit score?

A: Enrolling in a DMP may temporarily lower your credit score, but making consistent, on-time payments through the DMP can improve your credit score over time.

- Q: What are the risks of debt settlement?

A: Debt settlement can significantly damage your credit score and may result in lawsuits from your creditors.

- Q: How can I negotiate with my credit card company?

A: You can contact your credit card company and explain your financial situation, requesting a lower interest rate or a payment plan.

- Q: What is the best way to avoid credit card debt?

A: The best way to avoid credit card debt is to create a budget, track your spending, and avoid overspending.

- Q: Are there any government programs to help with credit card debt?

A: There are no specific government programs to help with credit card debt, but you may be eligible for other government assistance programs.

- Q: How can I improve my credit score?

A: You can improve your credit score by making on-time payments, keeping your credit utilization low, and avoiding new credit applications.

- Q: What should I do if I can’t afford my credit card payments?

A: Contact your credit card company immediately and explain your situation. They may be willing to offer a payment plan or other assistance.

- Q: How do I choose a reputable credit counseling agency?

A: Look for a non-profit agency that is accredited by the NFCC or the FCAA and has a good reputation.

Conclusion & Strategic Call to Action

In conclusion, while the term ‘credit card debt loopholes’ may be misleading, there are legitimate and effective strategies for managing and reducing credit card debt. These strategies include balance transfers, debt consolidation, credit counseling, and negotiation with creditors. It’s crucial to approach these options responsibly and be wary of unrealistic promises or scams. By understanding your financial situation, exploring available resources, and making informed decisions, you can take control of your debt and achieve financial freedom.

The future of credit card debt management will likely involve increased access to financial education and personalized solutions. As technology advances, we can expect to see more innovative tools and resources that empower individuals to manage their debt effectively.

Ready to take the next step towards debt freedom? Contact our experts for a free consultation on credit card debt reduction strategies and discover the best options for your unique situation. Share your experiences with credit card debt management in the comments below!