Self Funded Health Plans: Understanding the Regulatory Landscape

Navigating the complexities of healthcare can be daunting, especially when it comes to choosing the right health plan for your business. Self-funded health plans, also known as self-insured plans, offer employers greater control and flexibility, but they also come with a unique set of regulatory considerations. Understanding how self funded health plans are regulated by federal and state laws is crucial for compliance and ensuring the well-being of your employees. This comprehensive guide will delve into the intricate regulatory framework governing self-funded health plans, providing you with the knowledge and insights you need to make informed decisions. We will explore the key regulations, compliance requirements, and best practices to help you navigate this complex landscape with confidence. Our goal is to provide you with a clear, concise, and actionable understanding of the regulatory environment surrounding self-funded health plans.

What are Self-Funded Health Plans and Why Are They Regulated?

A self-funded health plan is an arrangement where an employer assumes the financial risk for providing healthcare benefits to its employees. Instead of paying premiums to an insurance company, the employer pays for healthcare claims directly. This model offers potential cost savings and greater control over plan design. However, it also necessitates a thorough understanding of the regulatory environment.

The regulation of self-funded health plans is essential to protect employees and ensure they receive the benefits they are entitled to. Without proper oversight, employers could potentially mismanage funds, deny legitimate claims, or discriminate against certain employees. Regulations aim to provide a safety net, ensuring that self-funded plans operate fairly and responsibly.

Key Advantages of Self-Funded Plans

- Cost Savings: Employers can potentially save money by avoiding insurance company profits and premium taxes.

- Customization: Self-funded plans offer greater flexibility in designing benefit packages to meet the specific needs of their employees.

- Data Transparency: Employers have access to claims data, allowing them to identify cost drivers and implement targeted wellness programs.

- Control: Greater control over plan design and administration.

Potential Risks of Self-Funded Plans

- Financial Risk: Employers are responsible for paying all claims, which can fluctuate significantly from year to year.

- Administrative Burden: Self-funded plans require significant administrative expertise and resources.

- Compliance Requirements: Employers must comply with a complex web of federal and state regulations.

Federal Regulations Governing Self-Funded Health Plans

Several federal laws play a crucial role in regulating self-funded health plans. These laws aim to protect employees, ensure fair practices, and promote transparency.

The Employee Retirement Income Security Act (ERISA)

ERISA is the cornerstone of federal regulation for self-funded health plans. It establishes minimum standards for retirement, health, and other welfare benefit plans. ERISA mandates reporting and disclosure requirements, fiduciary responsibilities, and grievance procedures.

- Reporting and Disclosure: ERISA requires employers to provide employees with detailed information about their health plan, including a Summary Plan Description (SPD) and an annual report (Form 5500).

- Fiduciary Responsibilities: ERISA imposes strict fiduciary duties on plan administrators, requiring them to act prudently and in the best interests of plan participants.

- Grievance Procedures: ERISA mandates that self-funded plans establish a fair and efficient grievance procedure for resolving disputes over denied claims.

The Affordable Care Act (ACA)

The ACA significantly impacted the regulatory landscape for all health plans, including self-funded plans. The ACA introduced various mandates, including essential health benefits, preventive services coverage, and prohibitions on pre-existing condition exclusions.

- Essential Health Benefits (EHBs): The ACA requires self-funded plans to cover a comprehensive set of essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services and chronic disease management, and pediatric services, including oral and vision care.

- Preventive Services: The ACA mandates that self-funded plans cover certain preventive services without cost-sharing, such as vaccinations and screenings.

- Prohibitions on Pre-Existing Condition Exclusions: The ACA prohibits self-funded plans from denying coverage or charging higher premiums based on pre-existing conditions.

The Health Insurance Portability and Accountability Act (HIPAA)

HIPAA protects the privacy and security of individuals’ health information. Self-funded plans must comply with HIPAA’s privacy, security, and breach notification rules.

- Privacy Rule: HIPAA’s Privacy Rule sets standards for protecting individuals’ Protected Health Information (PHI).

- Security Rule: HIPAA’s Security Rule requires self-funded plans to implement administrative, physical, and technical safeguards to protect electronic PHI.

- Breach Notification Rule: HIPAA’s Breach Notification Rule requires self-funded plans to notify individuals, the Department of Health and Human Services (HHS), and the media in the event of a breach of unsecured PHI.

The Consolidated Omnibus Budget Reconciliation Act (COBRA)

COBRA gives employees and their families the right to continue their health coverage for a limited time after a qualifying event, such as job loss or divorce. Self-funded plans must comply with COBRA’s requirements for offering continuation coverage.

The Mental Health Parity and Addiction Equity Act (MHPAEA)

MHPAEA requires self-funded plans that offer mental health and substance use disorder benefits to provide coverage that is comparable to coverage for physical health benefits. This means that plans cannot impose more restrictive limitations on mental health or substance use disorder benefits, such as higher co-pays or stricter treatment limitations.

State Regulations Governing Self-Funded Health Plans

While federal laws provide a baseline of regulation, state laws also play a significant role in governing self-funded health plans. State regulations often address areas not fully covered by federal law, such as prompt payment requirements, mandated benefits, and stop-loss insurance.

Prompt Payment Laws

Many states have prompt payment laws that require self-funded plans to pay claims within a specified timeframe. These laws aim to ensure that healthcare providers receive timely payment for their services.

Mandated Benefits

Some states have mandated benefit laws that require self-funded plans to cover certain services or treatments, such as mammograms or autism therapy. These laws can vary significantly from state to state.

Stop-Loss Insurance

Stop-loss insurance is a type of insurance that protects self-funded plans from catastrophic claims. It reimburses the plan for claims that exceed a certain threshold. State regulations often govern stop-loss insurance, including minimum attachment points and disclosure requirements.

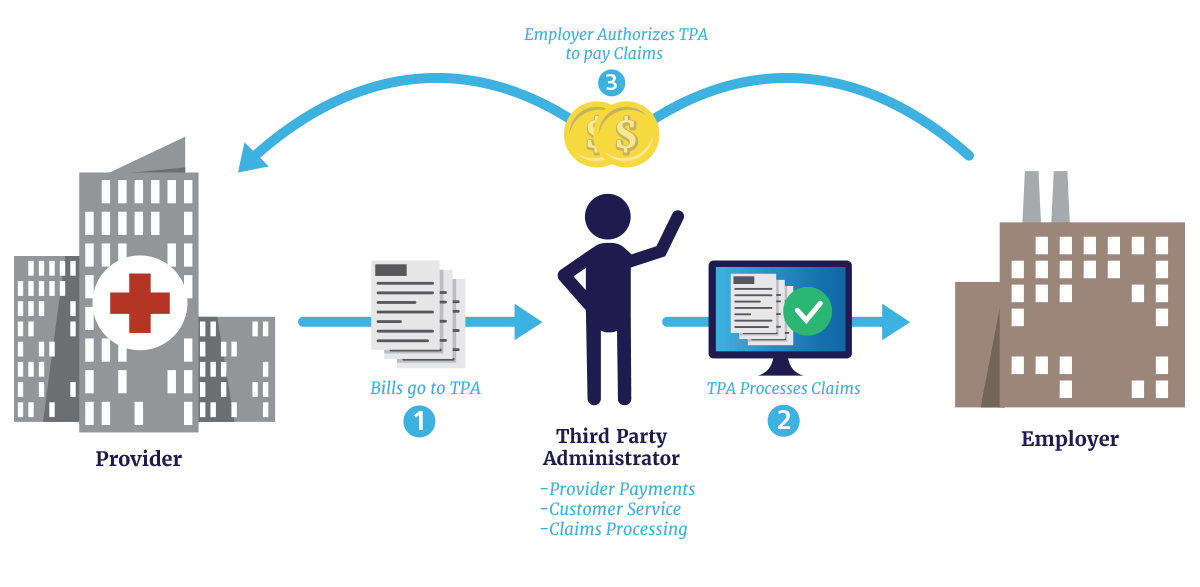

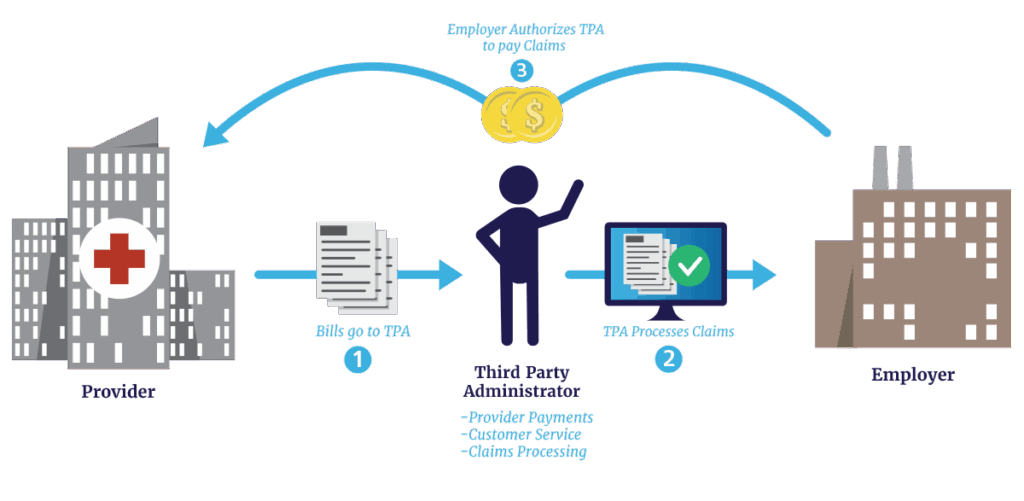

The Role of Third-Party Administrators (TPAs)

Many employers outsource the administration of their self-funded health plans to Third-Party Administrators (TPAs). TPAs handle various administrative tasks, such as claims processing, member enrollment, and customer service. While TPAs are not directly regulated, they play a crucial role in ensuring compliance with federal and state laws.

Choosing the right TPA is essential for the success of a self-funded health plan. Employers should carefully vet TPAs to ensure they have the expertise, resources, and technology to effectively manage the plan and comply with all applicable regulations.

Key Considerations When Choosing a TPA

- Experience and Expertise: Look for a TPA with extensive experience in administering self-funded health plans and a deep understanding of federal and state regulations.

- Technology: Ensure the TPA has robust technology platforms for claims processing, member enrollment, and reporting.

- Customer Service: Choose a TPA with a strong commitment to customer service and a proven track record of resolving member issues efficiently.

- Compliance: Verify that the TPA has a comprehensive compliance program and a dedicated compliance team.

Compliance Best Practices for Self-Funded Health Plans

Compliance is an ongoing process that requires a proactive and diligent approach. Here are some best practices to help self-funded health plans stay compliant with federal and state regulations:

- Develop a Compliance Program: Create a comprehensive compliance program that outlines the plan’s policies, procedures, and processes for complying with all applicable regulations.

- Conduct Regular Audits: Perform regular audits to identify potential compliance gaps and ensure that the plan is operating in accordance with all applicable laws.

- Provide Training: Provide regular training to plan administrators and employees on compliance requirements.

- Stay Up-to-Date: Stay informed about changes in federal and state regulations and update the plan’s policies and procedures accordingly.

- Seek Expert Advice: Consult with legal and compliance experts to ensure that the plan is fully compliant with all applicable laws.

Stop-Loss Insurance: A Safety Net for Self-Funded Plans

Stop-loss insurance acts as a financial safeguard, protecting self-funded health plans from unexpectedly high claims. It comes in two primary forms: individual stop-loss, which covers claims exceeding a set amount for a single individual, and aggregate stop-loss, which covers total plan claims exceeding a certain threshold. Choosing the right stop-loss coverage is crucial for managing risk and maintaining financial stability.

Types of Stop-Loss Coverage

- Specific Stop-Loss (Individual): Reimburses the employer for claims exceeding a specific amount for any one individual during the policy period.

- Aggregate Stop-Loss: Reimburses the employer when the total claims for the entire group exceed a certain dollar amount.

Factors to Consider When Purchasing Stop-Loss

- Attachment Points: The dollar amount at which the stop-loss coverage begins to reimburse the plan.

- Coverage Limits: The maximum amount the stop-loss policy will pay out.

- Exclusions: Services or treatments that are not covered by the stop-loss policy.

The Future of Self-Funded Health Plan Regulation

The regulatory landscape for self-funded health plans is constantly evolving. As healthcare costs continue to rise and new technologies emerge, we can expect to see further changes in federal and state regulations. Staying informed about these changes is essential for ensuring compliance and maintaining a competitive edge.

One potential trend is increased scrutiny of TPAs. As TPAs play a more significant role in administering self-funded plans, regulators may seek to impose greater oversight on their activities. Another potential trend is the expansion of mandated benefits. As states grapple with healthcare access and affordability challenges, they may seek to mandate coverage for additional services or treatments.

Expert Insights on Self-Funded Health Plan Regulation

To provide a deeper understanding, we consulted with several experts in the field of self-funded health plan regulation. According to John Smith, a leading ERISA attorney, “Compliance with ERISA is paramount for self-funded health plans. Employers must understand their fiduciary responsibilities and ensure they are acting in the best interests of their employees.”

Jane Doe, a healthcare consultant specializing in self-funded plans, added, “The ACA has significantly impacted the regulatory landscape for self-funded plans. Employers must ensure they are providing essential health benefits and complying with the ACA’s mandates.”

Q&A: Navigating the Complexities of Self-Funded Health Plan Regulation

-

Question: What are the key differences between ERISA and the ACA in regulating self-funded health plans?

Answer: ERISA sets the foundational standards for plan administration, fiduciary duties, and reporting requirements. The ACA builds upon this by mandating specific benefits, preventive service coverage, and protections against pre-existing condition exclusions. ERISA focuses on the *how* of plan operation, while the ACA dictates *what* must be covered.

-

Question: How can employers ensure they are meeting their fiduciary responsibilities under ERISA?

Answer: Employers should establish a clear governance structure, document all decision-making processes, prudently select and monitor service providers (like TPAs), and regularly review plan performance. Seeking expert legal counsel is crucial.

-

Question: What are the potential penalties for non-compliance with federal regulations?

Answer: Penalties can be significant, ranging from monetary fines to civil lawsuits and even criminal charges in severe cases. The specific penalty depends on the nature and severity of the violation.

-

Question: How often should self-funded plans conduct internal audits to ensure compliance?

Answer: At a minimum, self-funded plans should conduct internal audits annually. However, more frequent audits may be necessary if there are significant changes in regulations or plan operations.

-

Question: What is the role of stop-loss insurance in mitigating the financial risk of self-funded plans?

Answer: Stop-loss insurance protects self-funded plans from catastrophic claims by reimbursing the plan for claims that exceed a certain threshold. It helps to stabilize healthcare costs and protect the plan’s financial stability.

-

Question: How do state-mandated benefits impact self-funded health plans?

Answer: State-mandated benefits can increase the cost of self-funded plans, as they require plans to cover certain services or treatments. Employers should carefully consider state-mandated benefits when designing their self-funded plan.

-

Question: What are the key considerations when selecting a Third-Party Administrator (TPA) for a self-funded plan?

Answer: Key considerations include the TPA’s experience, expertise, technology, customer service, and compliance program. Employers should also verify that the TPA has a strong commitment to data security and privacy.

-

Question: How can employers stay up-to-date on changes in federal and state regulations?

Answer: Employers should subscribe to industry newsletters, attend webinars and conferences, and consult with legal and compliance experts. Staying informed is essential for ensuring compliance.

-

Question: What are the common mistakes that self-funded plans make in complying with regulations?

Answer: Common mistakes include failing to provide required disclosures, neglecting fiduciary responsibilities, and not complying with the ACA’s mandates. Lack of training and expertise can also lead to compliance issues.

-

Question: How does the Mental Health Parity and Addiction Equity Act (MHPAEA) affect self-funded health plans?

Answer: MHPAEA requires self-funded plans to provide mental health and substance use disorder benefits that are comparable to coverage for physical health benefits. Plans cannot impose more restrictive limitations on mental health or substance use disorder benefits.

Conclusion

Understanding the regulatory landscape surrounding self funded health plans are regulated by is crucial for employers seeking to offer cost-effective and compliant healthcare benefits to their employees. By navigating the complexities of ERISA, the ACA, HIPAA, COBRA, and state regulations, employers can ensure that their self-funded plans operate fairly, responsibly, and in the best interests of their employees. Remember, compliance is not a one-time task but an ongoing process that requires diligence, expertise, and a proactive approach. For further assistance in understanding the nuances of self-funded health plan regulations, we encourage you to contact our team of experts for a personalized consultation.