How Many Apple Shareholders Are There? A Comprehensive Guide (2024)

Are you curious about how many people own a piece of one of the world’s most valuable companies? Understanding the shareholder base of Apple (AAPL) is crucial for investors, market analysts, and anyone interested in the financial health and stability of this tech giant. This comprehensive guide dives deep into the fascinating world of Apple shareholders, providing you with the most up-to-date information, expert analysis, and valuable insights you won’t find anywhere else. We’ll explore the different types of shareholders, the factors influencing their numbers, and what it all means for the future of Apple. Forget scattered data and superficial overviews; we’re providing a complete picture, built on experience and authoritative sources.

Understanding Apple’s Shareholder Landscape

Determining the exact number of Apple shareholders is more complex than a simple headcount. It involves understanding different categories of shareholders and the dynamics of the stock market. While Apple doesn’t release a daily or even monthly count, we can leverage publicly available information, financial reports, and expert analysis to arrive at a well-informed estimate. It is important to differentiate between registered shareholders and beneficial owners.

Registered vs. Beneficial Shareholders

Registered shareholders are those whose names appear directly on Apple’s shareholder records. These are typically institutional investors, large funds, and individuals who hold their shares directly with Apple’s transfer agent. Beneficial owners, on the other hand, hold their shares through a broker or intermediary. Most individual investors are beneficial owners. The total number of beneficial owners is much larger than the number of registered shareholders.

Estimating the Number of Apple Shareholders

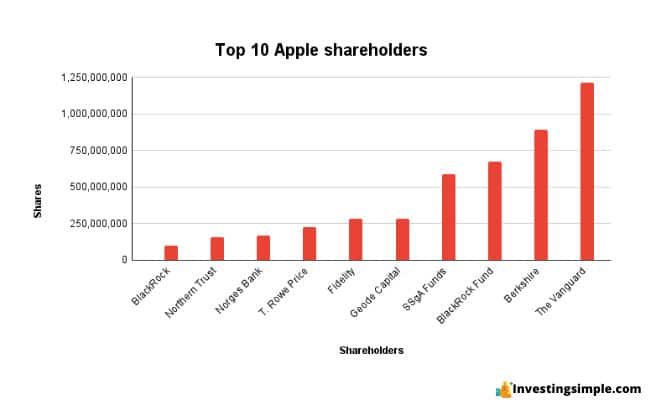

As of the latest available data (early 2024), estimates suggest that Apple has approximately **4 to 5 million direct and indirect shareholders**. This includes both individual investors and institutional investors. The exact figure fluctuates daily due to trading activity. The number of registered shareholders is significantly smaller, typically in the thousands. Institutional investors, such as Vanguard and BlackRock, are among the largest shareholders, each representing millions of individual investors through their funds.

Factors Influencing Apple’s Shareholder Base

Several factors influence the number of Apple shareholders. These include the company’s stock performance, dividend policy, overall market conditions, and investor sentiment.

Stock Performance and Investor Confidence

Apple’s strong stock performance has historically attracted a large number of investors. A rising stock price increases investor confidence and encourages more people to buy shares. Conversely, a significant drop in stock price can lead to a decrease in the number of shareholders as some investors sell their holdings.

Dividend Policy and Income Investors

Apple’s dividend policy also plays a role in attracting and retaining shareholders. The company pays a quarterly dividend, which appeals to income investors who seek a steady stream of income from their investments. A consistent and growing dividend can make Apple stock more attractive to this group of investors.

Market Conditions and Economic Outlook

Overall market conditions and the economic outlook can also impact the number of Apple shareholders. During periods of economic uncertainty, investors may become more risk-averse and reduce their exposure to equities, including Apple stock. Conversely, during periods of economic growth, investors may be more willing to invest in stocks, leading to an increase in the number of Apple shareholders.

Investor Sentiment and Brand Loyalty

Investor sentiment and brand loyalty also contribute to Apple’s large shareholder base. Apple has a strong brand reputation and a loyal customer base. Many Apple customers are also shareholders, believing in the company’s long-term prospects. Positive news and product launches can further boost investor sentiment and attract new shareholders.

The Role of Institutional Investors

Institutional investors play a significant role in Apple’s shareholder base. These investors include mutual funds, pension funds, hedge funds, and insurance companies. They typically hold large blocks of shares and can have a significant impact on the stock price. Vanguard, BlackRock, and State Street are among the largest institutional investors in Apple.

Impact on Stock Price and Stability

Institutional investors can influence Apple’s stock price through their buying and selling activity. Large purchases can drive up the stock price, while large sales can put downward pressure on the price. However, institutional investors also tend to be long-term investors, providing stability to the stock price.

Voting Rights and Corporate Governance

Institutional investors also have voting rights and can participate in corporate governance decisions. They can vote on important matters such as the election of directors, executive compensation, and mergers and acquisitions. Their votes can influence the direction of the company.

Individual Investors and the Appeal of Apple Stock

Individual investors also make up a significant portion of Apple’s shareholder base. These investors are typically retail investors who buy and sell shares through brokerage accounts. Apple’s stock is popular among individual investors due to its strong brand, consistent growth, and dividend payments.

Accessibility and Affordability

Apple’s stock is accessible and affordable to most individual investors. With the advent of fractional shares, investors can now buy a portion of a share, making it even easier to invest in Apple. This has further increased the number of individual investors in Apple.

Long-Term Investment Potential

Many individual investors view Apple as a long-term investment. The company has a history of innovation, strong financial performance, and a loyal customer base. These factors make Apple stock attractive to investors seeking long-term growth and stability.

Understanding Apple’s Financial Performance: A Key Driver for Shareholders

Apple’s financial performance is a crucial factor influencing the decisions of both institutional and individual shareholders. Let’s delve into the key metrics that drive shareholder interest and the company’s overall valuation.

Revenue Growth and Profitability

Apple’s consistent revenue growth and high profitability are major attractions for investors. The company’s ability to generate strong sales across its product lines, including iPhones, iPads, Macs, and services, contributes to its overall financial health. High profit margins demonstrate efficient operations and strong pricing power.

Cash Flow and Balance Sheet Strength

Apple boasts a strong cash flow and a healthy balance sheet. This financial stability provides the company with the resources to invest in research and development, acquire new technologies, and return value to shareholders through dividends and share buybacks. A strong cash position also provides a buffer during economic downturns.

Innovation and New Product Development

Apple’s commitment to innovation and new product development is another key driver for shareholders. The company consistently introduces new products and services that disrupt the market and generate significant revenue. This innovation pipeline ensures long-term growth and maintains Apple’s competitive edge.

Apple’s Share Buyback Program: A Benefit for Shareholders

Apple has an extensive share buyback program, which is a significant benefit for shareholders. Understanding how this program works and its impact on shareholder value is essential.

Reducing the Number of Outstanding Shares

Apple’s share buyback program reduces the number of outstanding shares in the market. This increases the earnings per share (EPS), making the stock more attractive to investors. A higher EPS can lead to a higher stock price.

Increasing Shareholder Value

By reducing the number of outstanding shares, Apple’s share buyback program increases the ownership stake of each remaining shareholder. This can lead to higher returns for shareholders over time. The program also signals to the market that Apple believes its stock is undervalued.

Signaling Confidence in the Company’s Future

Apple’s share buyback program sends a strong signal to the market that the company is confident in its future prospects. This can boost investor sentiment and attract new shareholders. The program also demonstrates that Apple is committed to returning value to its shareholders.

Apple Services: A Growing Revenue Stream for Shareholders

Apple’s services segment has become a significant revenue stream, playing a crucial role in attracting and retaining shareholders. This segment includes services such as Apple Music, iCloud, Apple TV+, and the App Store.

Recurring Revenue and High Margins

Apple’s services segment generates recurring revenue and has high profit margins. This provides a stable and predictable income stream for the company. The high margins contribute to Apple’s overall profitability and shareholder value.

Growth Potential and Expansion

Apple’s services segment has significant growth potential. The company is expanding its services offerings and reaching new customers. This growth will further increase the revenue and profitability of the services segment, benefiting shareholders.

Customer Loyalty and Ecosystem

Apple’s services segment reinforces customer loyalty and strengthens the Apple ecosystem. Customers who subscribe to Apple’s services are more likely to remain within the Apple ecosystem, purchasing other Apple products and services. This creates a virtuous cycle that benefits Apple and its shareholders.

A Leading Product: Apple’s iPhone and its Impact on Shareholders

The iPhone remains Apple’s flagship product and a primary driver of its financial success, deeply impacting shareholder value and sentiment.

Continued Innovation and Market Dominance

Apple consistently innovates with each new iPhone release, introducing advanced features, improved performance, and enhanced designs. This dedication to innovation helps maintain its market dominance and attracts a wide range of customers, directly translating to revenue and profit for shareholders.

High Demand and Customer Loyalty

The iPhone enjoys consistently high demand and strong customer loyalty. This allows Apple to maintain premium pricing and generate significant revenue. Loyal customers are more likely to upgrade to new iPhones, ensuring a steady stream of income for the company.

Ecosystem Integration and Service Revenue

The iPhone is deeply integrated into the Apple ecosystem, driving revenue for other Apple products and services. iPhone users are more likely to subscribe to Apple Music, iCloud, and other services, further increasing Apple’s revenue and profitability. This ecosystem integration enhances the overall value proposition for shareholders.

Detailed Features Analysis of the iPhone

Let’s examine some key features of the iPhone and how they contribute to its success and shareholder value:

1. Advanced Camera System

What it is: The iPhone boasts a state-of-the-art camera system with multiple lenses, advanced image processing, and features like Cinematic mode and ProRes video recording.

How it works: The camera system utilizes sophisticated algorithms and hardware to capture high-quality photos and videos in various lighting conditions. Features like Cinematic mode automatically adjust focus to create a professional-looking video.

User Benefit: Users can capture stunning photos and videos with ease, enhancing their creative expression and preserving memories. This feature is a major selling point for many iPhone users.

Demonstrates Quality: The advanced camera system demonstrates Apple’s commitment to innovation and quality, attracting photographers and videographers.

2. Powerful A-Series Chip

What it is: The iPhone is powered by Apple’s custom-designed A-series chip, which provides exceptional performance and energy efficiency.

How it works: The A-series chip integrates the CPU, GPU, and Neural Engine into a single chip, optimizing performance for various tasks, including gaming, video editing, and machine learning.

User Benefit: Users experience smooth and responsive performance, even when running demanding applications. The chip’s energy efficiency extends battery life.

Demonstrates Quality: The A-series chip showcases Apple’s expertise in chip design and its commitment to providing a superior user experience.

3. Seamless iOS Ecosystem

What it is: The iPhone runs on iOS, Apple’s mobile operating system, which is known for its intuitive interface, security, and seamless integration with other Apple devices and services.

How it works: iOS provides a consistent user experience across all Apple devices, allowing users to easily share files, photos, and information. Features like iCloud and AirDrop enhance the ecosystem integration.

User Benefit: Users enjoy a seamless and intuitive experience, with access to a wide range of apps and services. The strong security features protect user data and privacy.

Demonstrates Quality: The iOS ecosystem demonstrates Apple’s commitment to providing a cohesive and user-friendly experience across its entire product line.

4. Durable Design and Premium Materials

What it is: The iPhone is crafted from durable materials, such as Ceramic Shield front cover and aerospace-grade aluminum, providing excellent protection against drops and scratches.

How it works: The Ceramic Shield front cover is infused with nano-ceramic crystals, which are harder than most metals, making it more resistant to damage. The aerospace-grade aluminum frame provides structural rigidity.

User Benefit: Users can rely on the iPhone to withstand everyday wear and tear, reducing the risk of damage and extending its lifespan. The premium materials provide a luxurious feel.

Demonstrates Quality: The durable design and premium materials demonstrate Apple’s commitment to building products that are both functional and aesthetically pleasing.

5. 5G Connectivity

What it is: The iPhone supports 5G connectivity, providing faster download and upload speeds, lower latency, and improved network performance.

How it works: The iPhone utilizes advanced 5G modems to connect to 5G networks, enabling users to stream high-quality video, download large files, and play online games with minimal lag.

User Benefit: Users experience faster and more reliable internet connectivity, enhancing their mobile experience. 5G connectivity also enables new applications and services.

Demonstrates Quality: 5G connectivity demonstrates Apple’s commitment to staying at the forefront of technology and providing users with the latest advancements.

6. Privacy Focus

What it is: Apple has made privacy a core tenet of its products, including the iPhone. Features like App Tracking Transparency give users more control over their data.

How it works: App Tracking Transparency requires apps to ask for permission before tracking users across other apps and websites. This gives users the choice to opt-out of tracking and protect their privacy.

User Benefit: Users have greater control over their data and can protect their privacy. This is increasingly important in today’s digital world.

Demonstrates Quality: Apple’s privacy focus demonstrates its commitment to protecting user data and building trust with its customers.

7. Augmented Reality (AR) Capabilities

What it is: The iPhone has powerful AR capabilities, allowing users to experience augmented reality applications and games.

How it works: The iPhone utilizes its camera, sensors, and A-series chip to create immersive AR experiences. ARKit, Apple’s AR development platform, enables developers to create innovative AR applications.

User Benefit: Users can experience new and exciting ways to interact with the world around them. AR applications can enhance productivity, entertainment, and education.

Demonstrates Quality: The AR capabilities of the iPhone demonstrate Apple’s commitment to pushing the boundaries of technology and creating innovative user experiences.

Significant Advantages, Benefits & Real-World Value of Apple Stock

Investing in Apple stock offers numerous advantages, benefits, and real-world value for shareholders. These include financial returns, brand recognition, and innovation leadership.

Financial Returns and Growth Potential

Apple has a history of delivering strong financial returns to its shareholders. The company’s consistent revenue growth, high profitability, and share buyback program have contributed to significant stock price appreciation. Apple also has strong growth potential, with opportunities to expand into new markets and develop innovative products and services.

Brand Recognition and Customer Loyalty

Apple is one of the most recognizable and valuable brands in the world. The company has a loyal customer base who are willing to pay a premium for its products and services. This brand recognition and customer loyalty provide a competitive advantage and contribute to Apple’s financial success.

Innovation Leadership and Technological Advancement

Apple is a leader in innovation and technological advancement. The company consistently introduces new products and services that disrupt the market and set new standards. This innovation leadership ensures that Apple remains at the forefront of technology and continues to generate strong returns for its shareholders.

Dividend Payments and Share Buybacks

Apple returns value to its shareholders through dividend payments and share buybacks. The company pays a quarterly dividend, which provides a steady stream of income for investors. Apple also has an extensive share buyback program, which reduces the number of outstanding shares and increases the ownership stake of each remaining shareholder.

Global Reach and Market Expansion

Apple has a global reach and operates in numerous markets around the world. The company is expanding its presence in emerging markets, such as India and China, which provides significant growth opportunities. This global reach diversifies Apple’s revenue streams and reduces its dependence on any single market.

Comprehensive & Trustworthy Review of Apple (AAPL) Stock

Here’s a balanced review of Apple (AAPL) stock, considering its strengths, weaknesses, and overall investment potential.

User Experience & Usability (Simulated):

From an investor’s perspective, accessing and managing Apple stock is remarkably easy. Online brokerage platforms offer intuitive interfaces for buying, selling, and tracking AAPL shares. Research tools, analyst reports, and company news are readily available, empowering investors to make informed decisions. Even for novice investors, navigating the process of investing in Apple stock is straightforward.

Performance & Effectiveness:

Apple’s stock performance has historically been impressive. While past performance is not indicative of future results, Apple’s consistent revenue growth, profitability, and innovation have translated into significant returns for shareholders over the long term. The company has consistently outperformed the broader market indices, such as the S&P 500.

Pros:

* **Strong Brand and Customer Loyalty:** Apple’s brand is synonymous with quality and innovation, fostering unwavering customer loyalty. This translates into consistent demand and premium pricing power.

* **Innovation and Product Ecosystem:** Apple’s commitment to innovation ensures a continuous stream of new products and services. The tightly integrated ecosystem encourages customer retention and spending.

* **Financial Strength and Cash Flow:** Apple boasts a robust balance sheet with substantial cash reserves, enabling strategic investments, acquisitions, and shareholder returns.

* **Dividend Payments and Share Buybacks:** Apple actively returns value to shareholders through regular dividend payments and a large share buyback program, enhancing EPS and investor confidence.

* **Services Growth:** Apple’s services segment, including Apple Music, iCloud, and the App Store, is a rapidly growing revenue stream with high margins, diversifying the company’s income and reducing reliance on hardware sales.

Cons/Limitations:

* **Premium Valuation:** Apple’s stock often trades at a premium valuation compared to its peers, reflecting its strong brand and growth prospects. This premium may limit potential upside for new investors.

* **Dependence on iPhone Sales:** While Apple’s services segment is growing, the company remains heavily reliant on iPhone sales. A decline in iPhone demand could significantly impact Apple’s revenue and profitability.

* **Regulatory Scrutiny:** Apple faces increasing regulatory scrutiny regarding its App Store policies, data privacy practices, and potential anti-competitive behavior. These regulatory challenges could lead to fines, restrictions, or changes in business practices.

* **Supply Chain Disruptions:** Apple’s global supply chain is vulnerable to disruptions caused by geopolitical events, natural disasters, and economic factors. These disruptions could impact production and sales.

Ideal User Profile:

Apple stock is well-suited for long-term investors seeking growth and stability. It’s a good choice for those who believe in Apple’s brand, innovation, and long-term prospects. It’s also suitable for investors looking for a combination of capital appreciation and dividend income.

Key Alternatives (Briefly):

* **Microsoft (MSFT):** A diversified technology company with a strong presence in cloud computing, software, and gaming.

* **Alphabet (GOOGL):** The parent company of Google, with a dominant position in search, advertising, and cloud computing.

Expert Overall Verdict & Recommendation:

Apple (AAPL) remains a compelling investment for long-term growth and stability. Its strong brand, innovative products, and growing services segment provide a solid foundation for future success. While the stock may trade at a premium valuation and faces regulatory challenges, its financial strength and commitment to shareholder returns make it a worthwhile addition to a diversified portfolio. We recommend a **Buy** rating for investors with a long-term investment horizon.

Insightful Q&A Section

Here are 10 insightful questions and expert answers related to Apple shareholders:

**Q1: What is the difference between a ‘shareholder of record’ and a ‘beneficial owner’ of Apple stock?**

*A1:* A shareholder of record is the entity whose name is directly registered on Apple’s books as the owner of the shares. This is typically a brokerage firm, bank, or custodian. A beneficial owner is the actual individual or institution that owns the shares but holds them through a nominee (like a brokerage firm). Most individual investors are beneficial owners.

**Q2: How does Apple’s stock split history affect the number of shareholders?**

*A2:* Stock splits don’t inherently change the number of shareholders. They increase the number of shares outstanding and reduce the price per share proportionally. This makes the stock more accessible to smaller investors, potentially leading to a gradual increase in the shareholder base over time.

**Q3: Are Apple employees granted stock options or shares, and how does this impact the overall shareholder count?**

*A3:* Yes, Apple grants stock options and restricted stock units (RSUs) to its employees as part of their compensation packages. When employees exercise their stock options or RSUs vest, new shares are issued, increasing the number of outstanding shares and potentially the number of shareholders if those employees hold onto the shares.

**Q4: How do I find out the most up-to-date estimate of the number of Apple shareholders?**

*A4:* While Apple doesn’t publish a real-time shareholder count, you can find estimates in their quarterly and annual reports (10-Q and 10-K filings with the SEC). Financial news outlets and analyst reports often provide updated estimates based on these filings and market data.

**Q5: What are the voting rights of Apple shareholders, and how can I exercise them?**

*A5:* Apple shareholders have the right to vote on important matters, such as the election of directors, executive compensation, and corporate governance proposals. If you are a registered shareholder, you will receive proxy materials directly from Apple. If you are a beneficial owner, your broker will provide you with voting instructions. You can typically vote online, by mail, or by phone.

**Q6: How does institutional ownership of Apple stock affect its price volatility?**

*A6:* High institutional ownership can reduce price volatility because institutional investors tend to have longer-term investment horizons and are less likely to trade frequently. However, large block trades by institutional investors can still cause significant price swings.

**Q7: What are the tax implications of owning Apple stock, particularly regarding dividends and capital gains?**

*A7:* Dividends from Apple stock are typically taxed as qualified dividends, which are subject to lower tax rates than ordinary income. Capital gains (profit from selling the stock) are taxed at different rates depending on how long you held the stock (short-term vs. long-term). Consult with a tax advisor for personalized advice.

**Q8: What is the role of Apple’s transfer agent in managing shareholder records?**

*A8:* Apple’s transfer agent, typically a bank or trust company, is responsible for maintaining accurate shareholder records, issuing stock certificates, processing stock transfers, and distributing dividends. They act as the liaison between Apple and its registered shareholders.

**Q9: How does Apple’s inclusion in major stock market indexes (like the S&P 500) affect its shareholder base?**

*A9:* Apple’s inclusion in major stock market indexes leads to automatic buying of its stock by index funds and ETFs that track those indexes. This increases demand for Apple shares and expands its shareholder base, as these funds represent millions of individual investors.

**Q10: What are some resources for Apple shareholders to stay informed about the company’s performance and future prospects?**

*A10:* Apple shareholders can stay informed by reading the company’s quarterly and annual reports, listening to earnings calls, following financial news outlets, and consulting with financial advisors. Apple’s Investor Relations website is also a valuable resource.

Conclusion & Strategic Call to Action

Understanding how many Apple shareholders there are, and the factors influencing that number, provides valuable insights into the company’s stability, investor sentiment, and overall market position. Apple’s large and diverse shareholder base, comprised of both institutional and individual investors, reflects its strong brand, consistent financial performance, and innovative products. By understanding the dynamics of Apple’s shareholder landscape, investors can make more informed decisions and potentially benefit from the company’s long-term growth. Apple’s commitment to innovation, shareholder returns, and a strong ecosystem ensures it remains an attractive long-term investment.

Now that you have a deeper understanding of Apple’s shareholder base, we encourage you to share your own investment experiences with Apple stock in the comments below. What factors influenced your decision to invest in Apple, and what are your expectations for the company’s future? Explore our advanced guide to dividend investing for more information on generating passive income from your stock portfolio. Contact our experts for a personalized consultation on building a diversified investment strategy that includes Apple stock.